I am reviewing the White Paper the Fed just released:

“All U.S. bank holding companies with year-end 2008 assets exceeding $100 billion were required to participate in the assessment, which began February 25. These institutions collectively hold two-thirds of the assets and more than half the loans in the U.S. banking system.”

One thing struck me right away — unless I am misunderstanding something, this stress test does not appear to be very stressful.

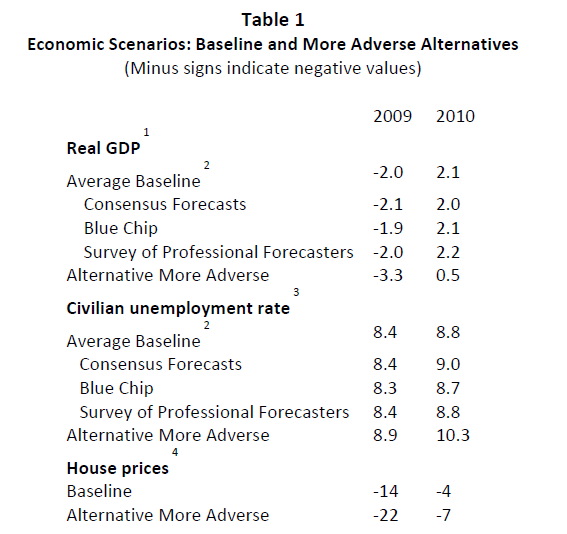

Consider the following baseline and “Stressed” components:

Further, let me point out that the Consensus estimates, professional forecasters and blue chip surveys have all been awful — terribly wrong — during this entire fiasco. Using their wildly optimistic estimates impugns this entire process. When your marriage is on the rocks, you don’t ask the same jamoke who introduced you to your spouse for marital advice. (Let me hasten to add that I am happily married and this is just a visceral example).

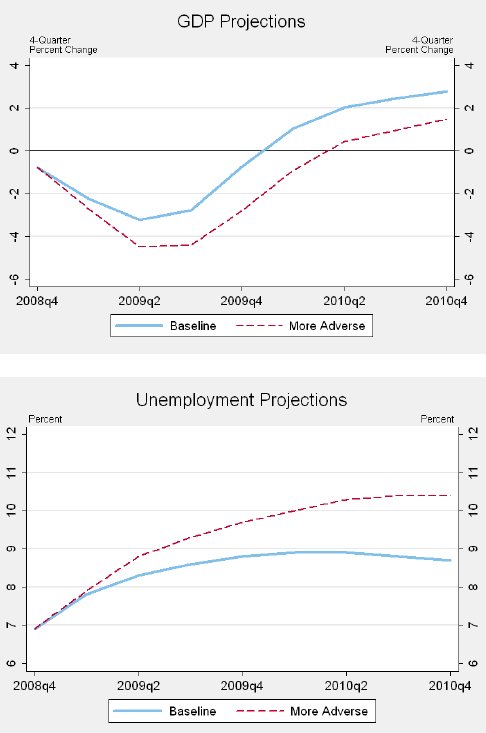

Using the Q4 as the starting point, have a look at the charts:>

>

The baseline GDP scenario starts from Q4, then adds an additional modest contraction for the baseline, and a less modest deeper contraction for the “more adverse” test, i.e., a modest worsening of the economy.

None of these reflect another deep set of contractions — and they certianly do not reflect the sort of panic economy we saw from September 2008 til January of this year.

The bottom line is that for a stress test, these weren’t very stressful . . .

>

Source:

The Supervisory Capital Assessment Program: Design Summary (287 KB PDF)

Board of Governors of the Federal Reserve System, April 24, 2009

http://www.federalreserve.gov/newsevents/press/bcreg/bcreg20090424a1.pdf

What's been said:

Discussions found on the web: