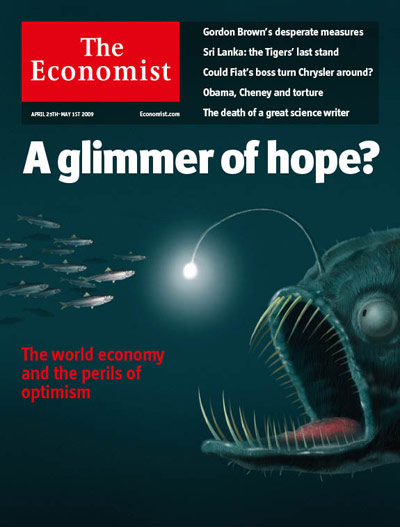

Nice cover image from the Economist on the brown shoots.

Excerpt:

“But, welcome as it is, optimism contains two traps, one obvious, the other more subtle. The obvious trap is that confidence proves misplaced—that the glimmers of hope are misinterpreted as the beginnings of a strong recovery when all they really show is that the rate of decline is slowing. The subtler trap, particularly for politicians, is that confidence and better news create ruinous complacency. Optimism is one thing, but hubris that the world economy is returning to normal could hinder recovery and block policies to protect against a further plunge into the depths.”

Here’s the cover image:

Hat tip Gary

>

Source:

A glimmer of hope?

The worst thing for the world economy would be to assume the worst is over

Economist, April 23rd 2009

http://www.economist.com/opinion/displayStory.cfm?story_id=13527685&

What's been said:

Discussions found on the web: