>

Today – SPMs are down 14.60 in Sunday night trading because Obama’s chief economic adviser, Larry Summers, asserted while appearing on Fox News Sunday, that the economic freefall is over but, “I expect the economy will continue to decline… [with] sharp declines in employment for quite some time this year.” (Reuters)

• “The anticipation over the white paper appears to be much ado about nothing,” said Josh

Rosner…“The most significant numbers provided by the Fed in the paper appear to be the page

numbers.”…

• “A lot of triple talk,” said Jim Glickenhaus… “I think they’re going to say while things are bad, the end is not at hand. Maybe.”

• “The question I have, by using fourth-quarter numbers, is this skewed positively?” said Lawrence Kaplan, an attorney with Paul Hastings, who served as a senior attorney in the chief counsel’s office at the Office of Thrift Supervision. “Because January and February were pretty lousy, and as a result that’s when it hit the fan.” (Bloomberg)

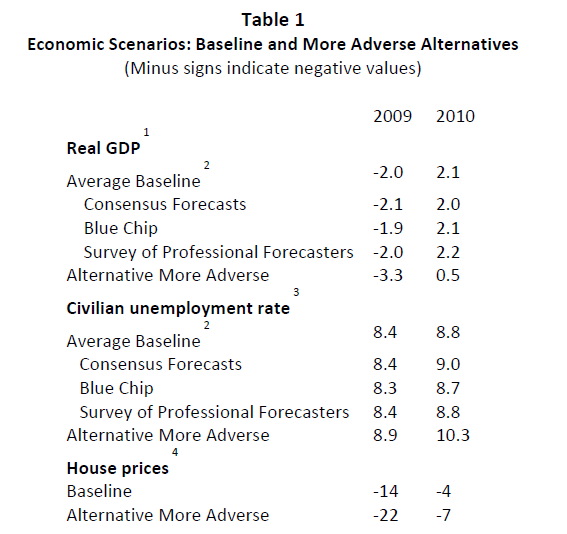

As most people guessed, the ‘stress test’ is an innocuous exercise based on rosy economic projections. Besides, why is a ‘stress test’ needed when there are already three agencies (Fed, FDIC, OCC) that apply metrics to measure banks’ solvency and financial condition?

A major problem with the ‘stress test’ is it depends on modeling and it’s the precise practice responsible for much of this economic and financial mess. It’s extraordinary that so many people believe that the Fed and Treasury, after missing the financial disaster, housing debacle, recession and derivative implosion, can now extrapolate economic conditions and resultant financial affects from its models. How did all that rocket-science modeling for subprime defaults and securitization workout? Yet many people already forget or ignore this reality.

Here’s another reality that most investors are missing – banks must raise more capital. So who’s the patsy in recent days that has been driving financial stocks higher? The FT: Fed will seek bank capital increase. Some of the country’s biggest banks will be asked to raise more capital by US authorities following the completion of bank stress tests, senior Federal Reserve officials said on Friday. (Financial Times)

Banks May Need $1 Trillion After U.S. Tests, KBW Says (Bloomberg)

What few analysts realize is that economic ‘muddling’, the best case scenario for the next two years, gives no relief to an economy burdened with record debt. If you lose a high paying job and you are struggling to pay your debts, you will not suddenly be able to pay your debt with a job a Wal-Mart.

What analysts should do is quantify the US private and public sector debt load and then extrapolate the needed income and GDP to service the debt. And then they should calculate how much debt will implode with little or no income and GDP growth.

The ‘real budget deficit’, “Treasury Gross Public Debt”, is now $1.85 Trillion (Barron’s p. M70).

The most disturbing aspect of the current scheme to manipulate markets, economic data and industrial data into something benign enough to increase consumer confidence and reinflate assets is that it is the precise scheme that Easy Al and others perpetrated over many years. And it created the current mess.

Solons again are trying to inflate assets to a level that is a huge disconnect with economic reality in

the misguided belief that they can paper over structural US economic problems and fostering

‘confidence through asset bubbles’ that will translate into economic activity. We are back to square one in ‘the new economy’ gambit.

And because we are back to square one in ‘the new economy’ of inflating assets to paper over problems, the markets are diving back into inflation mode. Commodities are soaring; bonds are struggling even with Fed support and the dollar is finally buckling.

~~~

Bill King is a Wall Street veteran with 35 years of institutional equity, proprietary and derivatives trading experience, giving him a unique perspective on current market conditions and forecast. As author of The King Report, Bill’s candid observations and forecast on the economic, financial, and political forces that are impacting the markets is read by major institutions and hedge funds. However, this report is not the usual garden variety tripe that is issued by the financial media and Wall Street. Bill, in plain language, refutes conventional rant about Wall Street activity and articulates the real factors and impetuses that drive market activity. The inside world of Wall Street is far different than what is disseminated to the masses. Wall Street insiders seldom adorn their own portfolios or trading accounts with ‘recommended list’ issues.

What's been said:

Discussions found on the web: