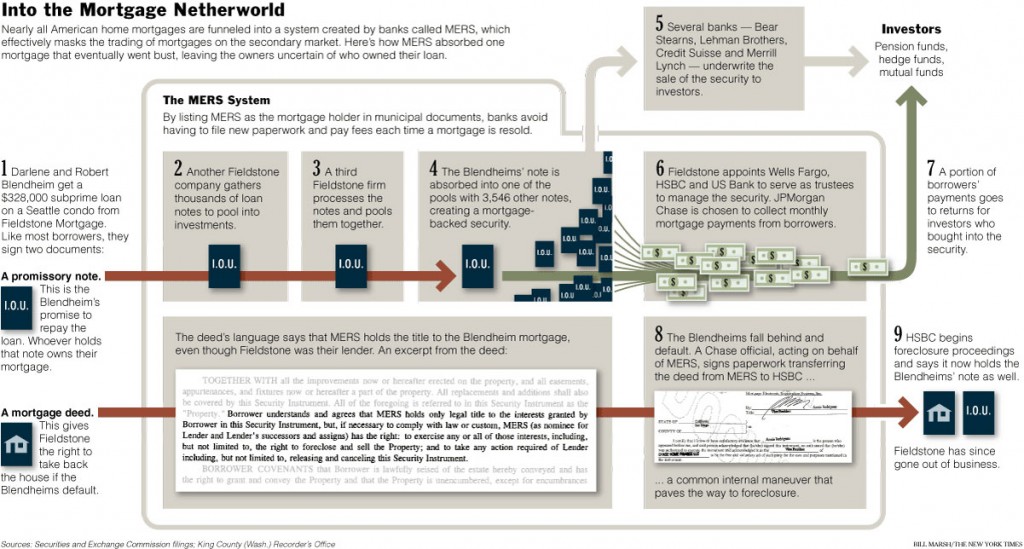

I meant to mention this NYT article from Thursday, with a wild graphical depiction of MERS — Mortgage Electronic Registration Systems — that holds over 60 million mortgages on American homes:

>

via NYT

The full article is worth reading . . .

>

Source:

Tracking Loans Through a Firm That Holds Millions

MIKE McINTIRE

NYT, April 23, 2009

http://www.nytimes.com/2009/04/24/business/24mers.html

What's been said:

Discussions found on the web: