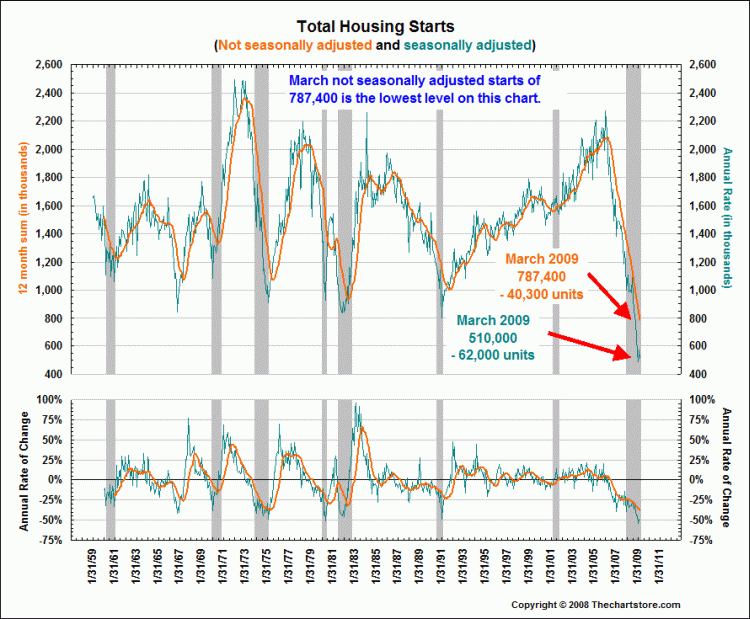

Here is half a century of Housing Starts, both Seasonally adjusted and NSA. (lower chart is the annual rate of change)

Note that we are now in uncharted territory — new home starts have never fallen to these levels for as long as the Commerce Department has been tracking this data (since 1959).

Note also the magnitude of the drop — it is unprecedented, having easily surpassed the 1982 collapse, the present circumstances have now become slightly worse than the 1973-75 fall.

Astonishing . . .

>

>

Source: Ron Griess of The Chart Store

>

What's been said:

Discussions found on the web: