Bill King writes:

US industrial production for March declined 1.5% m/m and 12.8% y/y. This is the biggest y/y decline since the end of WWII. Q1industrial production collapsed 20% annualized. Since the recession ‘officially’ commenced in December 2007, industrial production is down 13.3% and factory production has declined 15.7%, which is also the largest decline since the end of WWII.

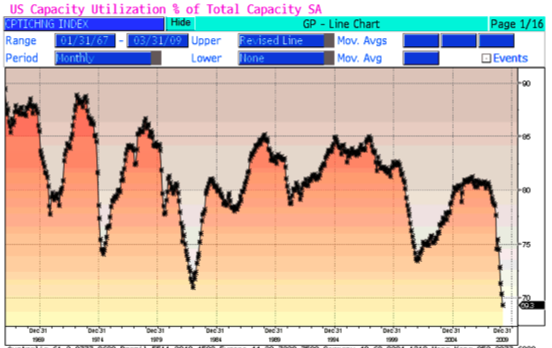

Q4 industrial production declined at a 12.7% annualized rate. So the past two quarters are showing a depression-like contraction in industrial production…Capacity Utilization fell to 69.3% in March. This is the lowest reading in the history of the series, which began in 1967.

The March industrial production data and February revision verifies our suspicious about too-good-to-be true auto production, industrial production and other economic data for February.

CPI fell 0.1% in March m/m and 0.4% y/y. This is the first annual decline since 1955.

What's been said:

Discussions found on the web: