Bg Picture Conference Schedule

Here is the penultimate schedule for the Conference on Wednesday — you can register for the last few seats here. (The ultimate...

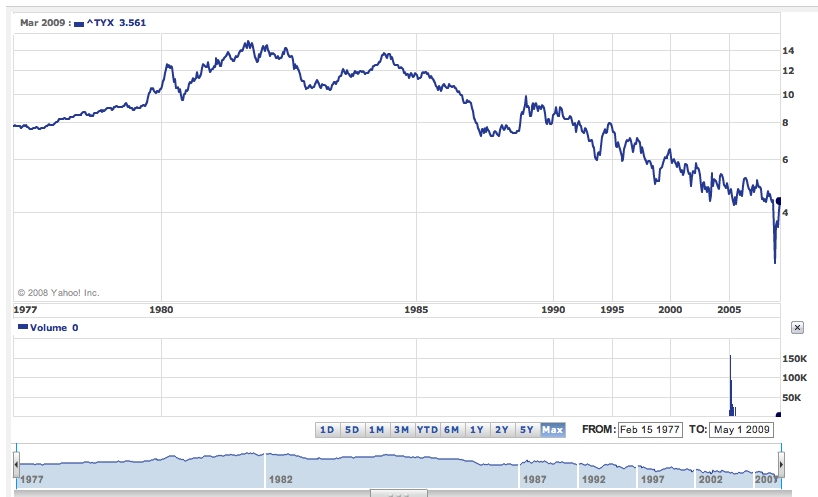

Nice thirty year chart showing the net change in interest rates, via the 30-year treasury bond. Given the high (inverse) correlation...

Nice thirty year chart showing the net change in interest rates, via the 30-year treasury bond. Given the high (inverse) correlation...

Source: CXO Advisory Group In addition to the major stock market indices rising for a third consecutive month, some of the other...

Source: CXO Advisory Group In addition to the major stock market indices rising for a third consecutive month, some of the other...

Get subscriber-only insights and news delivered by Barry every two weeks.