Well, I asked for lower prices earlier, and that’s what we got:

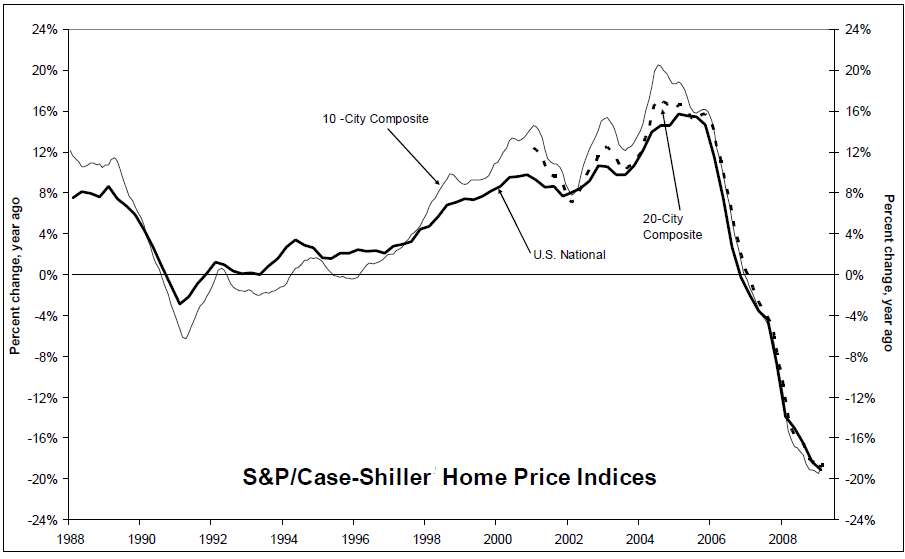

Home prices continued falling at record paces, according to the Case Shiller Home Price Index.

Annual (-19.1%), quarterly (-7.5%) and monthly (-2.2%) data continue to show prices reverting back towards levels not seen for years.

>

March 2009 Case Shiller Home Price Index

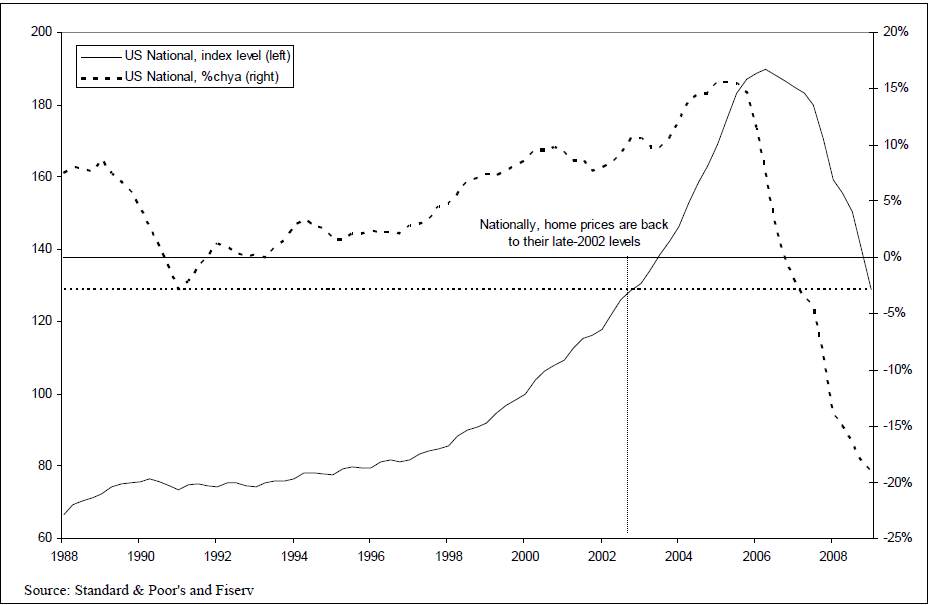

As of the most data, prices have returned to 2002 levels; Will pre-2000 levels be next?

>

S&P/Case-Shiller U.S. National Home Price Index

>

Sources:

Nationally, Home Prices Began 2009 with Record Declines

S&P, May 26, 2009

http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_csmahp/0,0,0,0,0,0,0,0,0,2,1,0,0,0,0,0.html

What's been said:

Discussions found on the web: