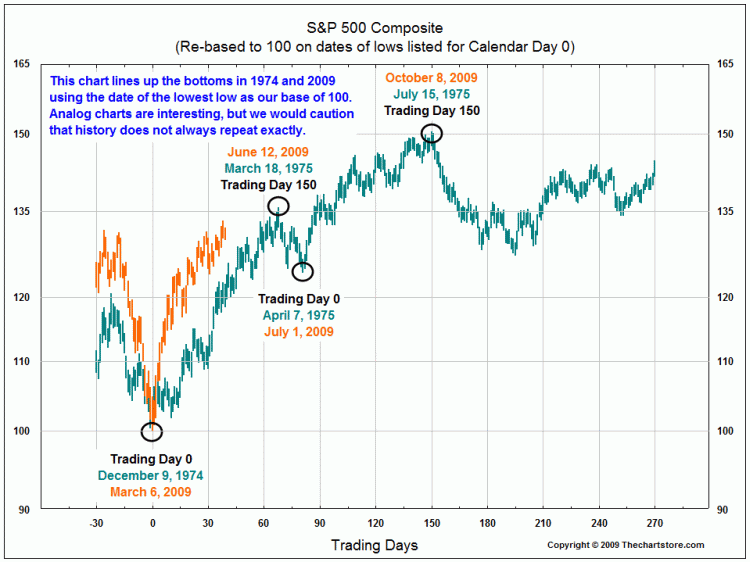

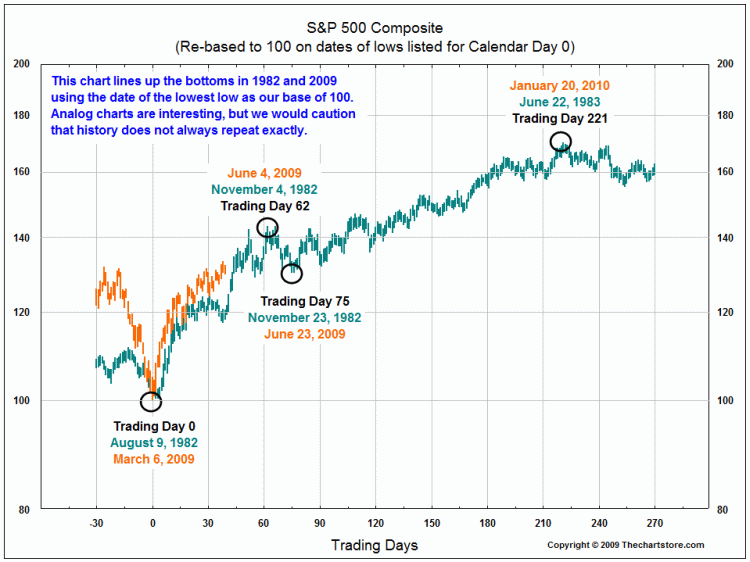

Earlier this morning, I asked whether the Market Rally was more reminscent of 1974 or 1982.

Courtesy of Ron Geiss of The Chart Store, here are 3 comparos that are worth looking at: 1973 sell off vs 2007, the 1974 rally 2009, and the 1982 bottom lows vs 2009.

>

>

1974 Rally versus 2009

>

>

>

Thanks, Ron!

What's been said:

Discussions found on the web: