The NYT has a local section of the Sunday paper — its different for Long Island, Westchester, Connecticut, New Jersey etc.

If you weren’t looking closely you may have missed the multi-regional approach:

My delivered Sunday NYT local section has the headline: “Long Island Foreclosures Rise, With No End in Sight.” There are similar but unique discussions for Connecticut, Westchester and New Jersey. All 4 articles were co-written by Janet Roberts. (A few excerpts follow).

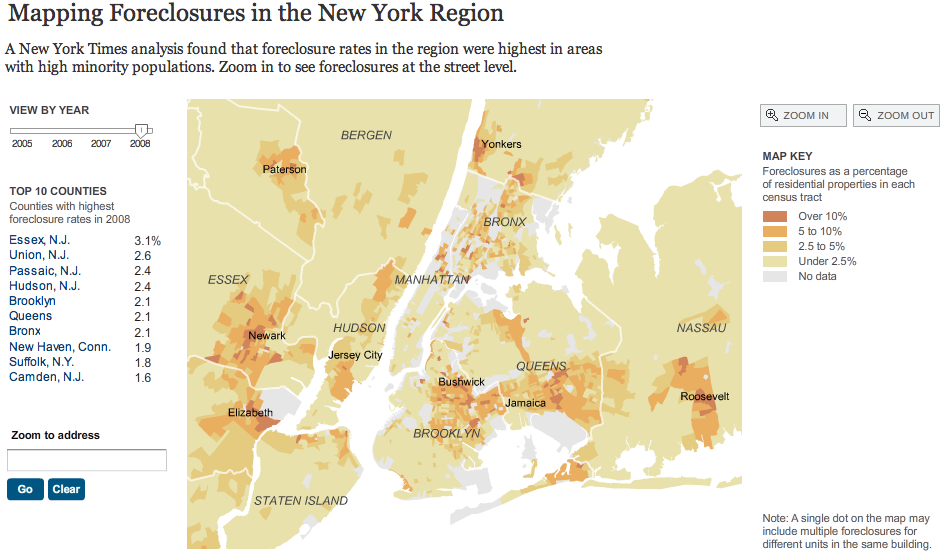

Jump online, and there is an interactive map (below) showing the change from 2005* 08 in foreclosure activity in the region.

Long Island:

“Over all, Long Island’s foreclosure rate is 3.7 percent, with at least 31,000 homes in some stage of foreclosure from 2005 through August 2008, according to the data, from The Long Island Real Estate Report. That is slightly higher than the 3.3 percent rate for the region, covering New York City, western Connecticut, Long Island and New Jersey.

What worries housing counselors and policymakers is that Long Island’s housing problems appear to be worsening. Recent bank data on mortgage delinquencies show that at least 6 percent of mortgages held by Long Island homeowners were 90 days or more past due, compared with 3.5 percent during the same period last year.”

Westchester:

“Still, the foreclosure wallop has affected even vintage Westchester neighborhoods like the Rochelle Heights and Rochelle Park enclaves in New Rochelle, where the Tudors and colonials were built a century ago when the country’s first bedroom communities were laid out and where homes not so long ago fetched a million dollars and more. Seven houses on Hamilton Avenue in those two neighborhoods are in various stages of being taken over or managed by banks, as are more than a dozen other of the enclaves’ 350 homes, according to the analysis by The Times.

Westchester’s painful toll tells much about how widespread this decade’s home-buying frenzy was. In too many cases, families took out mortgages or refinanced on payment terms that gave them only the thinnest margin for error and left no cushion for a plunging housing market.

Nevertheless, The Times analysis shows that foreclosure has touched Westchester more lightly than other parts of the region. The foreclosure rate of 2.3 percent of all properties for the 32-month period analyzed is lower than the overall regional rate of 2.9 percent during that same period. Not surprisingly, higher-income communities experienced the lowest rates of foreclosures, and about one-third of Westchester ZIP codes, with median incomes of $100,000 or more in the 2000 census, fell into that category.”

Connecticut:

“More than 27,000 homes in Fairfield, Hartford, Litchfield and New Haven Counties were in some stage of foreclosure between January 2005 and August 2008, according to an analysis by The New York Times of data from the Warren Group. These counties have fared better than other parts of the New York metropolitan area. Their 3.3 percent average foreclosure rate falls below New York City’s rate of 4.6 percent and Long Island’s 3.7 percent rate.

However, there are indications that the foreclosure crisis could be worsening in Connecticut, based on statewide data on mortgage delinquencies showing that in March, 4.8 percent of the mortgages held by Connecticut homeowners were at least 90 days past due. That is up from 2.7 percent a year earlier.

This gives Connecticut the 13th-highest delinquency rate among the 50 states, according to First American CoreLogic, which collects data on about 85 percent of the nation’s residential mortgages. Connecticut’s rate is about the same as New York State’s and below New Jersey’s and far below the rate in Florida, where more than one in five homeowners are behind.”

New Jersey:

“At least 6 percent of Essex County homes — more than 10,000 in all — have been in foreclosure since 2005, the highest rate of any county in New Jersey, New York City, Long Island or the Connecticut suburbs, according to an analysis by The Times of more than 182,000 homes in foreclosure around the region from 2005 through August 2008.

More than 82,000 of those homes are in New Jersey. Plot them on a map, and it becomes clear that no corner of the state has escaped the economic downturn. Nor has the picture improved since last summer. Delinquency rates in 13 of New Jersey’s 21 counties are now among the highest in the region.”

The Times also noted that the highest rates of foreclosure in most of the region were in neighborhoods with mostly black and Hispanic residents. Many of these mortgages were subprime, and there is good reason to believe an unhealthy percentage of them involved predatory lending . . .

>

Mapping Foreclosures in the New York Region

click for interactive map

Chart courtesy of NYT

>

Source:

Long Island Foreclosures Rise, With No End in Sight

DERRICK HENRY and JANET ROBERTS

NYT, May 13, 2009

http://www.nytimes.com/2009/05/17/nyregion/long-island/17mortli.html

Foreclosure Crisis in Westchester Crosses Economic Boundaries

JOSEPH BERGER and JANET ROBERTS

NYT May 13, 2009

http://www.nytimes.com/2009/05/17/nyregion/westchester/17mortwe.html

Connecticut Foreclosure Crisis Appears to Be Worsening

CHRISTINE HAUGHNEY and JANET ROBERTS

NYT, May 15, 2009

http://www.nytimes.com/2009/05/17/nyregion/connecticut/17forect.html

In New Jersey, Dreams of a Better Life Dashed by Foreclosure Crisis

KAREEM FAHIM and JANET ROBERTS

NYT, May 14, 2009

http://www.nytimes.com/2009/05/17/nyregion/new-jersey/17mortnj.html

Minorities Affected Most as New York Foreclosures Rise

MICHAEL POWELL and JANET ROBERTS

NYT, May 15, 2009

http://www.nytimes.com/2009/05/16/nyregion/16foreclose.html?ref=connecticut

See Also:

American Dream Threatened

Slide Show

http://www.nytimes.com/slideshow/2009/05/17/nyregion/17mort_index.html

Treasury Offers Incentives for Mortgage Modifications

Dawn Kopecki

Bloomberg, May 14 2009

http://www.bloomberg.com/apps/news?pid=20603037&sid=aW1qiy.dU4fc&

What's been said:

Discussions found on the web: