“We’re about to have a big problem. Foreclosures were bad last year? It’s going to get worse.”

-Morris A. Davis, a real estate expert at the University of Wisconsin.

>

This is a theme I have been hammering on for some time: As more people lose their jobs, we will see increasing foreclosures, adding further stress to banks’ already ugly balance sheets.

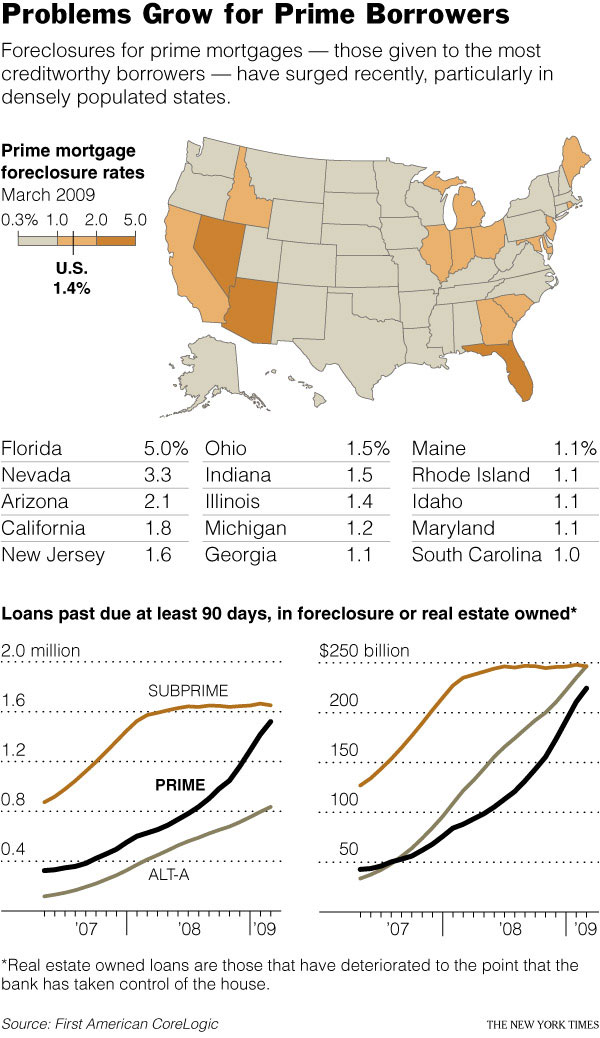

As the New York Times notes, the number of prime mortgages that were “delinquent at least 90 days, were in foreclosure or had deteriorated to the point that the lender took possession of the home” jumped enormously as job losses accelerated. Over the period when BLS was reporting 500k plus job losses a month, from November’08 to February ’09, the numbers of distressed properties “increased more than 473,000, exceeding 1.5 million.” Total loan value = more than $224 billion. (Sources: The Times, First American CoreLogic).

Thus, even if the recession ended tomorrow, the US will still have another 500k – one million foreclosures. And if the recession continues for another 6 months to a year, well, you do the math. (Hint: About 2 – 3 X as many)

Excerpt:

“In the latest phase of the nation’s real estate disaster, the locus of trouble has shifted from subprime loans — those extended to home buyers with troubled credit — to the far more numerous prime loans issued to those with decent financial histories.

With many economists anticipating that the unemployment rate will rise into the double digits from its current 8.9 percent, foreclosures are expected to accelerate. That could exacerbate bank losses, adding pressure to the financial system and the broader economy. . .

Economists refer to the current surge of foreclosures as the third wave, distinct from the initial spike when speculators gave up property because of plunging real estate prices, and the secondary shock, when borrowers’ introductory interest rates expired and were reset higher.”

Note that these foreclosures are not the exotic no money down I/O ARMs from the early phase of the housing collapse. Rather, these are “modest borrowers whose loans fit their income.”

A few last data points to consider (as of February 2009):

• Foreclosure rates among prime borrowers have been growing fastest in states with higher unemployment.

• Economy.com expects mortgage defaults in 2009 caused by unemployment to double, from 29% in 2008 to 60% in 2009;

• Prime mortgages that are distressed (90 days delinquent, foreclosure, REO) are greater than 1.5 million;

• Alt-A loans — those given to people with slightly tainted credit — rose to 836,000.

• Subprime mortgages that were “distressed” reached 1.65 million;

• From February 2008 to Feb 2009, total dollar value of distressed mortgages increased 60% in dollar terms;

• More than four million loans worth $717 billion were “distressed” in February.

All told, that’s about 4 million problem mortgages out there. My guess is half go into foreclosure. So far, the Obama admin aid to homeowners have seen less than 55,000 mortgages modified.

What this means, for those of you still paying attention, is that we will see lower RE prices, more bank stress, a lot more distressed sales, and no normalization of RE markets for some time.

The best you can hope for is some “stabilization” — if you consider 60% or more of all existing home sales (and many new home sales) to be distressed sales, foreclosures or bank owned properties — as “stable.”

I got your real estate bottom right here . . .

>

click for larger graphic

>

Source:

Job Losses Push Safer Mortgages to Foreclosure

PETER S. GOODMAN and JACK HEALY

NYT May 24, 2009 http://www.nytimes.com/2009/05/25/business/economy/25foreclose.html

~~~

What's been said:

Discussions found on the web: