It seems that Traders love today’s NFP data. Let’s take a closer look at the actual numbers to see what we can tease out:

-Nonfarm payroll employment decline in April (-539,000);

-Total recession job losses (December 2007 forward) now total 5.7 million;

-That is 6.5 million job losses per year on an annualized basis;

-Private-sector employment fell by 611,000; the differential between NFP and private sector employment is primarily new hires for the 2010 Census;

-U3 Unemployment rose from 8.5 to 8.9%; unemployment is now at a 25-year high;

-U6 Unemployment, the broadest measure of “labor underutilization” rose to 15.8%; This is up 77.5% (6.6 percentage points) from a year ago;

–Birth Death adjustment added 226k to the total of employed workers, (April is a pretty big month for this historically)

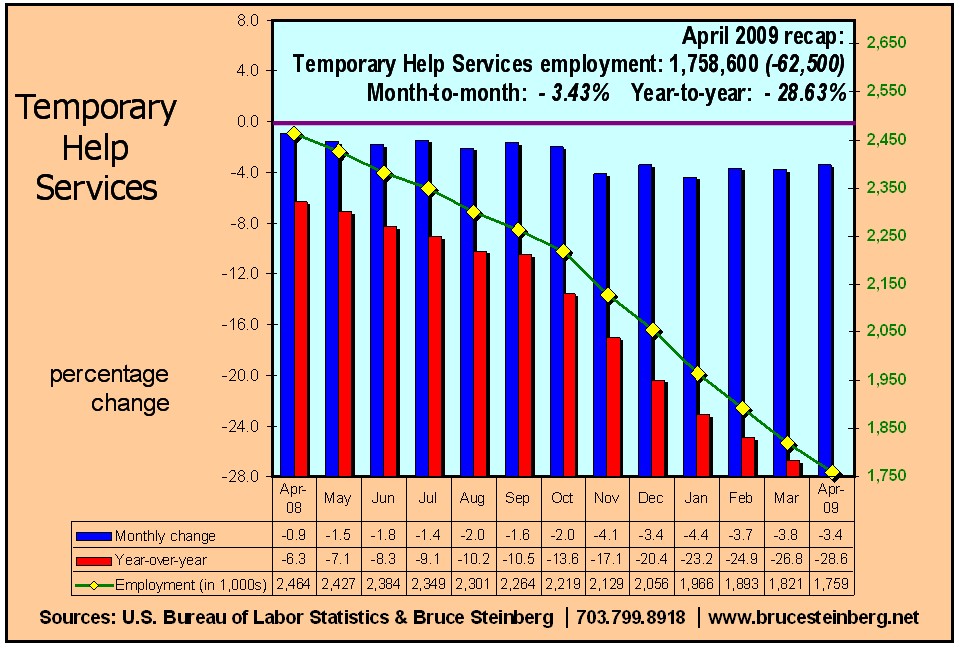

-Temporary Help Services was down 3.4%; Year-to-year loss was nearly 29%. Total Temporary Help losses are now over 910,000 (-34 percent) since December 2006.

-All sectors saw job losses except Education, health services and government;

-Downward revisions made to February and April were for a net loss of 66,ooo positions;

Two additional things to note:

Its hard wrapping my head around a more than half million monthly job loss as signs of stabilization;

Second, I hasten to point out that the “adverse” scenario the Treasury/Federal Reserve used in their stress test was a 9.5% Unemployment Rate. We should be there by sometime this summer, and above 10% by the end of the year . . .

>

chart courtesy of Brucesteinberg.net

What's been said:

Discussions found on the web: