Over the past month, I have heard quite a few people declare this to be the start of a new bull market. The kindest thing I can say in response to that is the jury is still out, but the weight of the evidence is inconclusive.

In terms of historical analogies, investors should be asking themselves: Is this move more like 1982 or 1974?

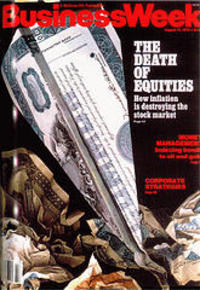

Consider: 1982 marked the end of a 16 year, secular bear market, which saw the Dow finally get over 1,000 on a permanent basis. It kissed that level in 1966, and again a few more times prior to breaching that level for good in 1982. After 16 years, nominal returns were zero, but on a real (inflation adjusted) basis, buy & hold investors lost nearly 90% of the purchasing power.

Consider: 1982 marked the end of a 16 year, secular bear market, which saw the Dow finally get over 1,000 on a permanent basis. It kissed that level in 1966, and again a few more times prior to breaching that level for good in 1982. After 16 years, nominal returns were zero, but on a real (inflation adjusted) basis, buy & hold investors lost nearly 90% of the purchasing power.

At the beginning of that 18 year long Bull market, equities were despised, bond yields were high and P/E ratios were single digits. History does not repeat precisely, but there is usually a rhyme involved.

I have noted in the past that following major bull runs, markets often have a major refractory period, wherein it takes years to work off the excesses of the prior period. Even in that period, markets will get deeply oversold and rally, and deeply overbought and sell off.The current secular bear is no different.

This could be 1982, but I doubt it. Instead, consider the 1973-76 period as a analog: The 23 month, 45% sell off was followed by 22 month, 76% rally. I could live through that again, as long as disco doesn’t come back also . . .

I’ll see if I can dig up a few relevant charts later.

>

Previously:

1966-1982 Trading Range (December 29th, 2005)

http://www.ritholtz.com/blog/2005/12/1966-1982-trading-range/

100 Year Dow Jones Industrials Chart (December 28th, 2005)

http://www.ritholtz.com/blog/2005/12/100-year-dow-jones-industrials-chart/

Looking at the Very Very Long Term (November 6th, 2003)

http://www.ritholtz.com/blog/2003/11/looking-at-the-very-very-long-term/

What's been said:

Discussions found on the web: