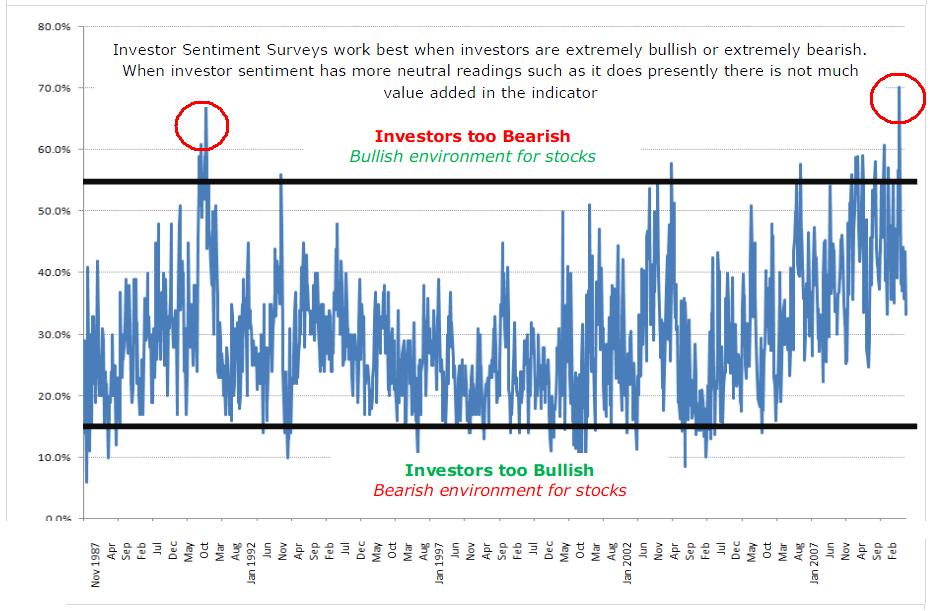

As we noted last week, Sentiment was pretty neutral as the market tore higher (Sentiment Reading: Neutral).

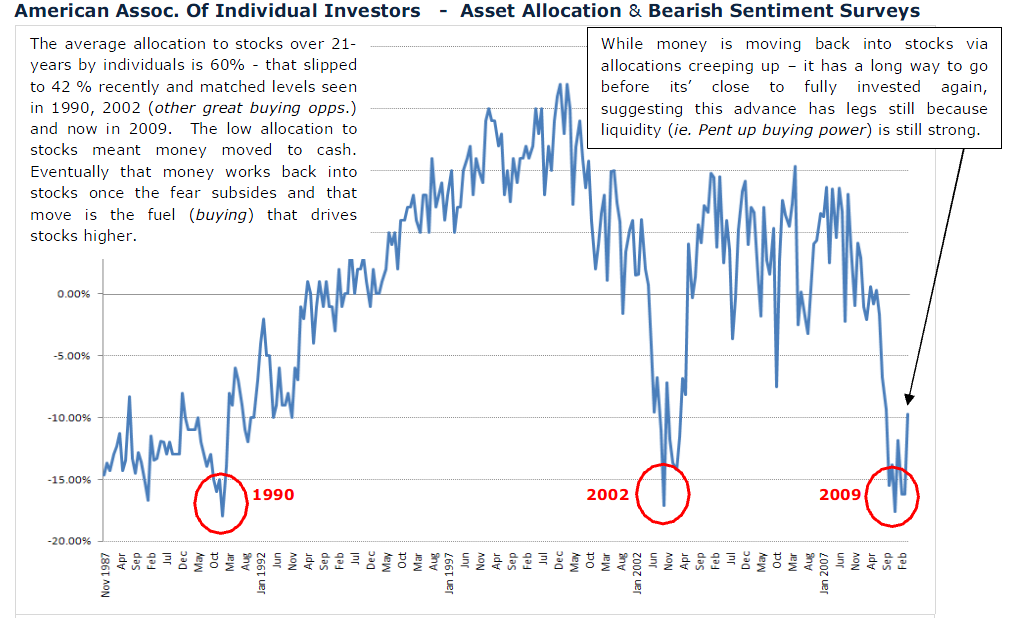

Have a look at the AAII Asset Allocation Chart is below. It suggests assets are being re-allocated back into equities, however the allocation still remains historically low, which suggests liquidity on the sidelines is still high and can power stocks higher for some times (especially absent a slow offerings calendar).

>

The second chart, AAII bearish sentiment, which scored a huge contrarian buy signal in early March — as big as the one after the 1987 crash — when it hit 70% of respondents to the survey were bearish. It has since moderated, however, and is not at levels yet that would be deemed a negative for stocks.

What's been said:

Discussions found on the web: