We always seem to discuss recessions and expansions in the “post War World II era.”

When you consider this period, you need to understand two major factors that occurred after the war: 1) the impact the returning GIs (and the entire Baby-Boom population) had on our economy, and 2) the often overlooked huge round trip that interest rates have taken.

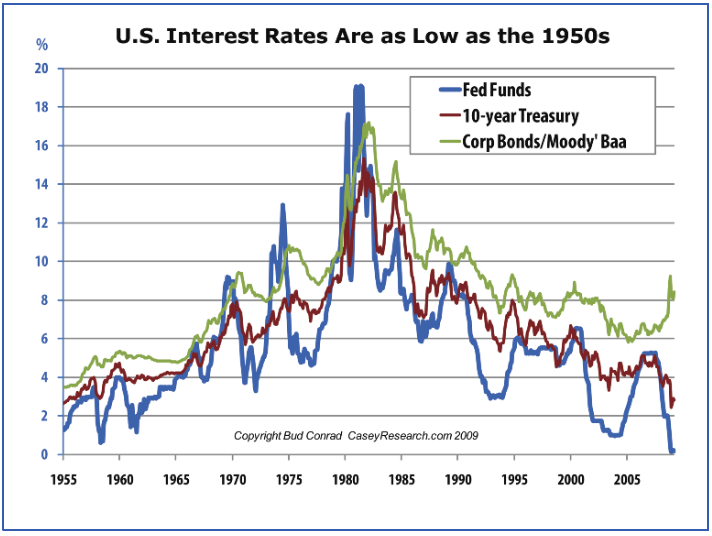

To look more closely at the latter, check out this chart, via Casey Research, showing a half century rise and fall in US interest rates:

>

Chart courtesy of Casey Research

>

Casey Research has a free “chart of the day” type service worth exploring.

What's been said:

Discussions found on the web: