On Wednesday, I noted that “GDP would have been even worse, if it wasn’t for how fast imports have plummeted; They are falling faster than exports, perversely creating a appearance of relative improvement . . .”

Robert F. Dieli, Ph.D. is a longtime observer of Wall Street and the Economy. His site is No Spin Forecast, where he runs Mr. Model, and his Analysis of First Quarter 2009 Real GDP — especially his take on the impact of these weaker imports on final GDP numbers — is dead on:

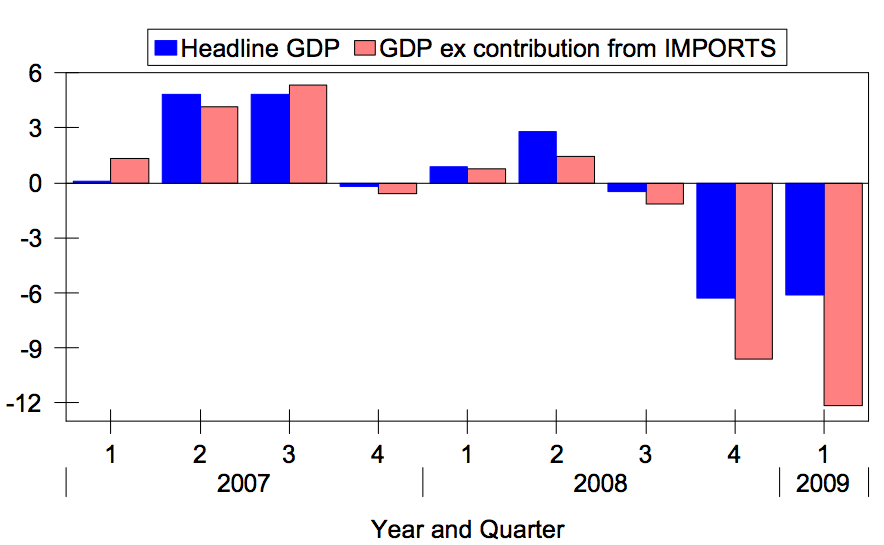

“An explanation about why the decline in imports is helping GDP growth. As you know, imports are subtracted from GDP. Because imports are declining in absolute terms, you get a positive effect from a negative negative. Just to be clear as to what this chart is telling us: the drop in imports contributed 6.05 percentage points to the GDP growth rate.

What this means is that without the contribution from imports, GDP declined at 12.15% annual rate in Q1. In other words, all of the domestic activity was, as the employment numbers suggested, in free fall! Now, this has some important implications for the profile of growth going forward. When imports stop dropping, and they will, the sign on this term will go back to its normal negative, and when it does, it will expose the true growth rate of the domestic economy. We had best hope that GPDI has gotten back on track by the time the positive effect of negative import growth wears off.”

In other words, without the impact of slowing imports, annualized GDP contraction would have been about 12%.

As is so often the case, the picture is terribly instructive:

Thanks Bob — Good stuff.

What's been said:

Discussions found on the web: