>

Our friend Brian alerted us to this USA/Today story: Benefit spending soars to new high

The recession is driving the safety net of government benefits to a historic high, as one of every six dollars of Americans’ income is now coming in the form of a federal or state check or voucher.

Benefits, such as Social Security, food stamps, unemployment insurance and health care, accounted for 16.2% of personal income in the first quarter of 2009, the Bureau of Economic Analysis reports. That’s the highest percentage since the government began compiling records in 1929. [More than 30s] In all, government spending on benefits will top $2 trillion in 2009 — an average of $17,000 provided to each U.S. household, federal data show… [This is not capitalism; this is a welfare state run amuck.]

Two major factors were at work on Thursday: 1) Expectations that the May Employment Report will be much better than expected; GS sees -475k; and 2) The Treasury will issue $127B of securities next week. This killed bonds and notes but induced traders to buy stocks and commodities on the asset allocation. The minor factor at work was RBC made Keycorp a ‘top pick’ and Bernstein upgraded Goldman to outperform. Thursday’s financial stock frenzy on only two upgrades illustrates market psychology.

Yesterday the Treasury said it will sell $127B of bills, notes and bonds next week – $35B in 3s, $19B in 10s and $11B of 30s, $31B in three-month bills and $31B in six-month bills.

Bloomberg: South Korea’s National Pension Service, the country’s largest investor, said it will maintain its U.S. government bond holdings even as it cuts the percentage they comprise. “We are planning to reduce the weightings of American Treasuries, but that doesn’t mean we will be selling Treasuries because our fund size is growing,” National Pension said in a statement in response to questions from Bloomberg News. “We don’t have a specific plan to sell Treasuries.”

BTW, The Fed monetized $7.49B of 2s and 3s on Thursday. After abstaining for about a week, the Fed has conducted back-to-back monetizations…Just yesterday Bernanke told Congress that the debt will not be monetized. What other lies is Ben telling?

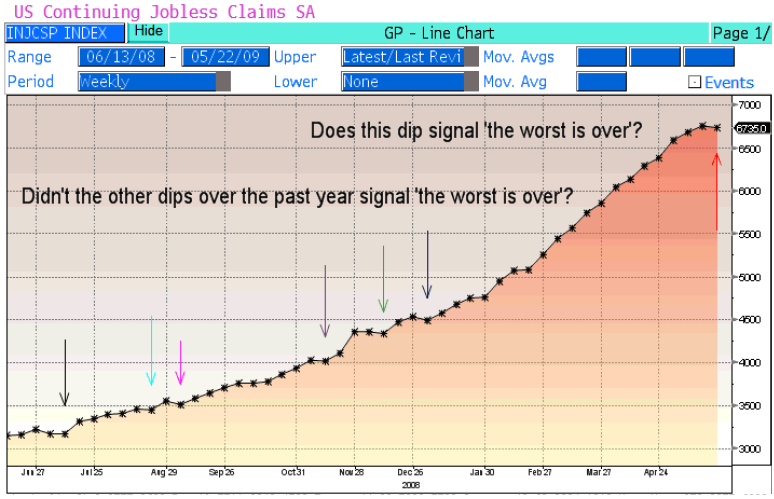

One week ago Initial Jobless Claims declined a tad while Continuing Claims made a new high. Street shills and their financial media stooges ignored the ugly Continuing Claims data and asserted ‘the worst is over’ because Initial Jobless Claims declined. Yesterday, Initial Jobless Claims declined 4k; a 5k decline was expected. And the previous week was revised 2k higher to 625k. But the cheerleaders decided to ignore the negative Initial Jobless Claims and trumpet the decline in Continuing Jobless Claims, the first dip this year, as a sign that the worst is over.

The following chart clearly illustrates an inconvenient truth: There have been several dips in Continuing Jobless Claims over the past year and they did NOT represent turning points.

Several retailers posted ugly results for May. Target same-store sales declined 6.1% in May (-4.3 exp)

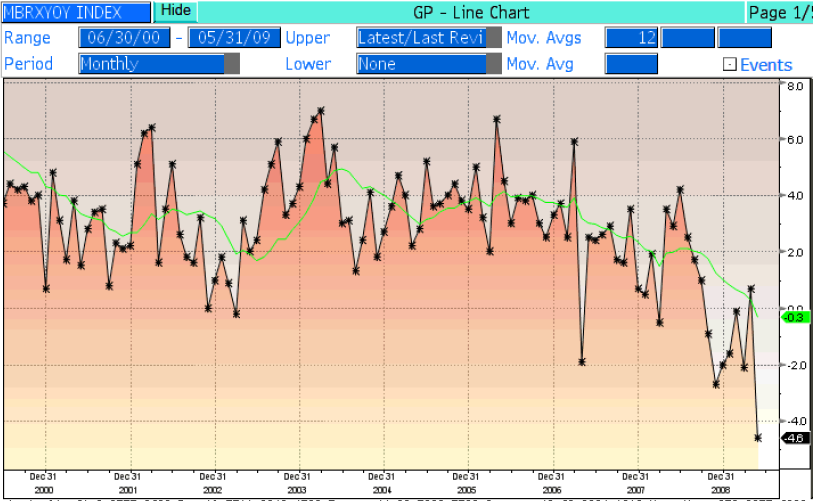

No green shoots or ‘the worst is over’ in the ICSC-Goldman Sachs Chain Store Sales Index

Target Chief Executive Gregg Steinhafel avers that ‘ RETAIL METRICS SAYS RETAILERS ARE STILL UNDER PRESSURE’.

What's been said:

Discussions found on the web: