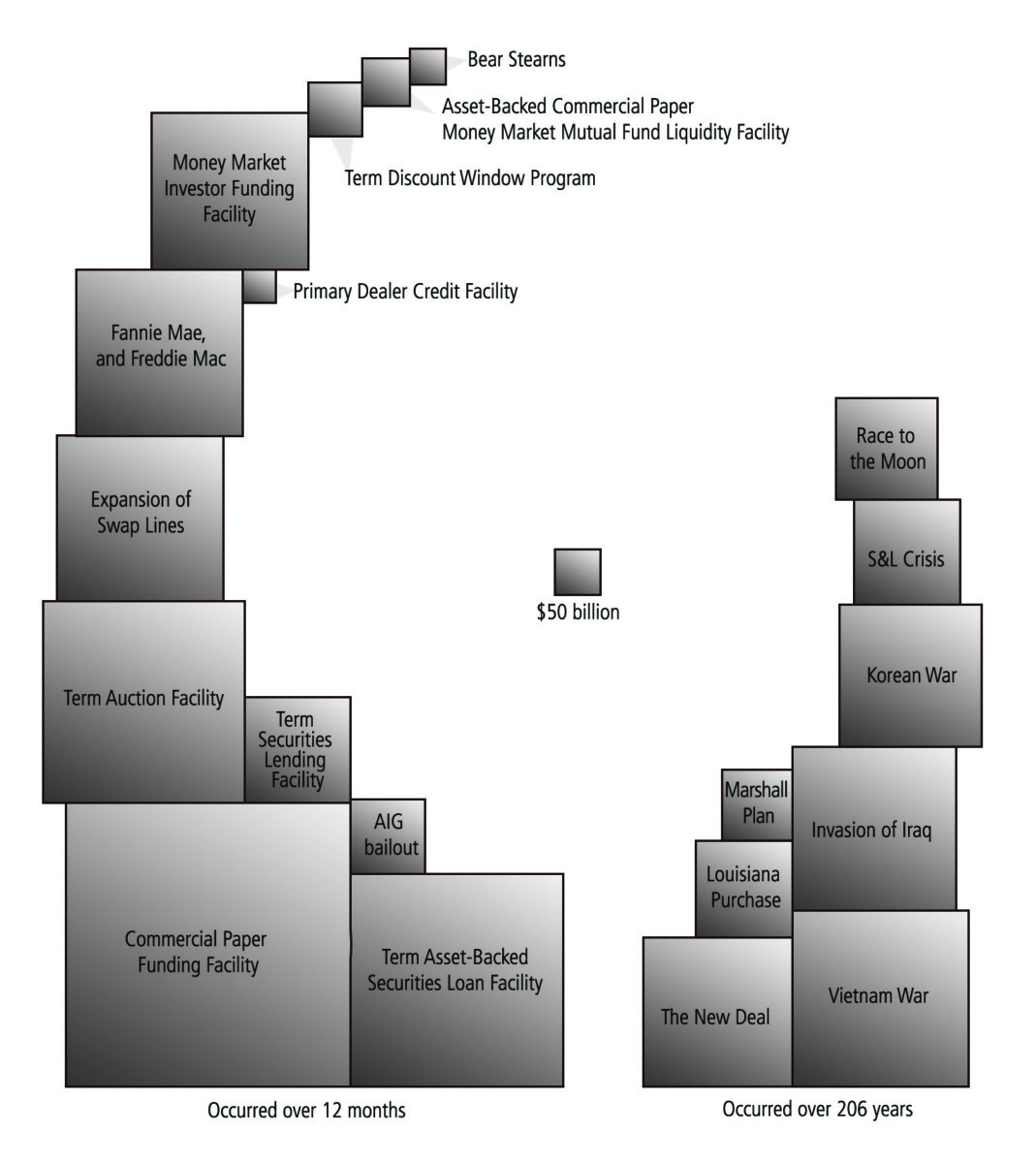

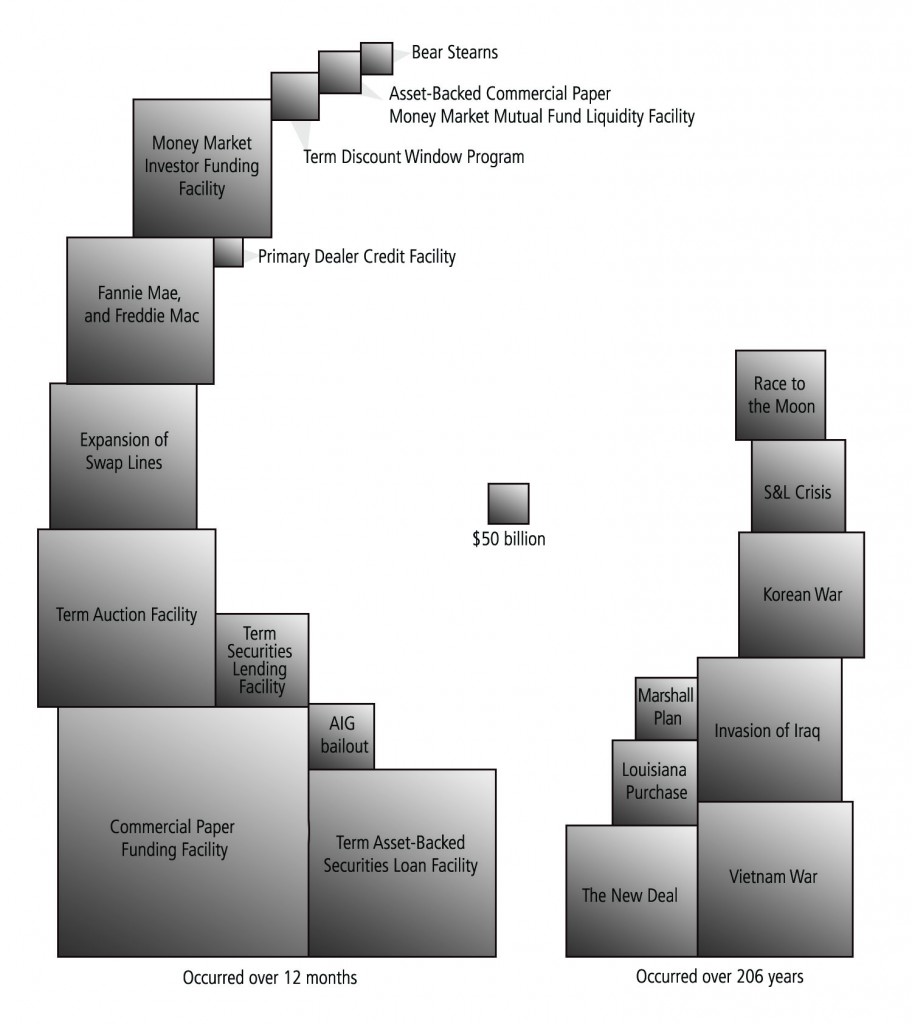

It is exceedingly difficult to convey exactly how much we are spending on all these bailouts. Whenever I start talking trillions (versus mere billions), I get puzzled looks from people. Humans have a hard time conceptualizing any number that large. I wanted a graphic way to clearly show how astonishingly ginormous the amounts involved were.

So I once again went to Jess Bachman at Wallstats. I gave him my list of expenditures (inflation adjusted of course!) and he went to work. This early Bailout Nation graphic shows the the total costs to the taxpayer of all the monies spent, lent, consumed, borrowed, printed, guaranteed, assumed or otherwise committed.

It is nothing short of astonishing.

It includes the total outlay for all the bailouts to date. In just about one short year (March 2008 – March 2009), the bailouts managed to spend far in excess of nearly every major one time expenditure of the USA, including WW1&2 (omitted from graphic), the moon shot, the New Deal, total NASA budgets (omitted from graphic), Iraq, Viet Nam and Korean wars — COMBINED.

206 years versus 12 months. Total cost: ~$15 trillion and counting . . .

>

>

Note: This was finished too late to make it into the hard cover edition of Bailout Nation, but it will be in next year’s paperback, and whenever the Kindle version finally shows up.

>

Previously:

Big Bailouts, Bigger Bucks (November 25th, 2008)

http://www.ritholtz.com/blog/2008/11/big-bailouts-bigger-bucks/

Bailout Nation: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy

Wiley (May 26, 2009)

What's been said:

Discussions found on the web: