For the past few years, I have been railing about data nonsense such as Core CPI, Birth/Death adjustment, Home Affordability Index, etc. I sometimes forget that not every current TBP reader has been tracking this stuff since the mid-2000s with us.

Several comments yesterday, and a kindly email asking me if I knew about U6 (heh) or about the BDA, led me to today’s post.

A quick refresher on the Birth Death adjustment: In 2001, the Bush administration directed the BLS to compensate for the tendency of the Establishment Survey to miss new business formation and the impact on employment. Previously, BLS tended to under report new jobs in the beginning of a a cycle turn. What the new B/D Adjustment series did was take new incorporation filings per state, and deduce from them that new jobs were being created. (That took effect around 2003).

This improved somewhat the ability to capture new jobs at the start of the cycle. But the flaw in the adjustment was that the model radically overstated job creation at the end of the cycle. Say a firm goes out of business, or lays off 100s of workers. They form new shops, incorporating these start ups. According to the BLS, that is job creation.

But in reality, a steady paycheck with benefits has now been transformed into a start up with none of the above. And as we know, 90% of all new businesses eventually fail.

How misleading is the BD adjustment at the end of the cycle? Consider that in 2007, 75% of the BLS newly created jobs were due to the B/D adjustment. That did a nice job masking the actual problems beneath the surface.

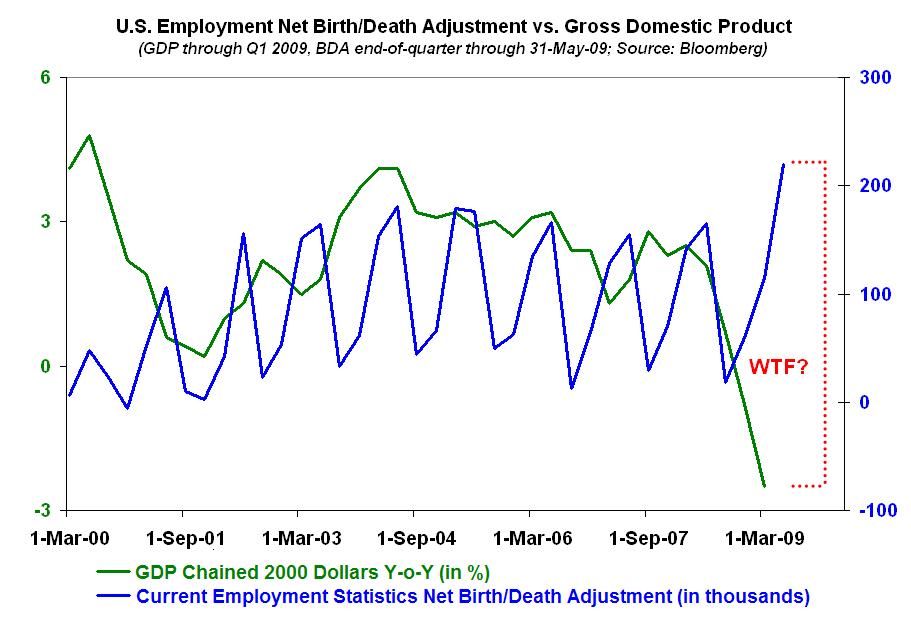

Which brings us to Friday’s NFP report. As the chart below shows, as GDP has plummeted, the BD adjustment has created ever more jobs. Is that reasonable? Does that reflect reality? Or, is it another version of 2007 data stream creating a misleading construct of reality? I suspect its the latter . . .

>

Source, Mike Panzner (B/D Data series source here)

>

The caveat is the BDA end-of-quarter data can be a little volatile on a monthly basis (see actual data below). Note also Bloomberg’s data only goes back to 1/31/00.

>

Previously:

NFP: Even Worse Than Reported (December 8th, 2008)

http://www.ritholtz.com/blog/2008/12/nfp-even-worse-than-reported/

What's been said:

Discussions found on the web: