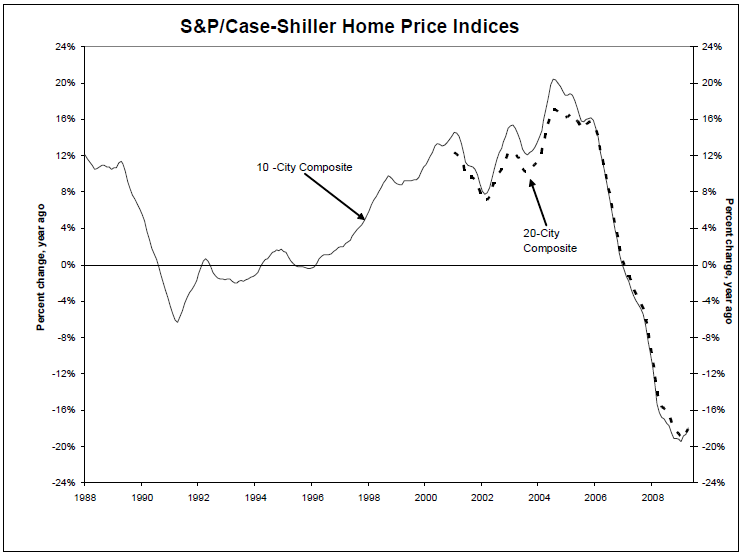

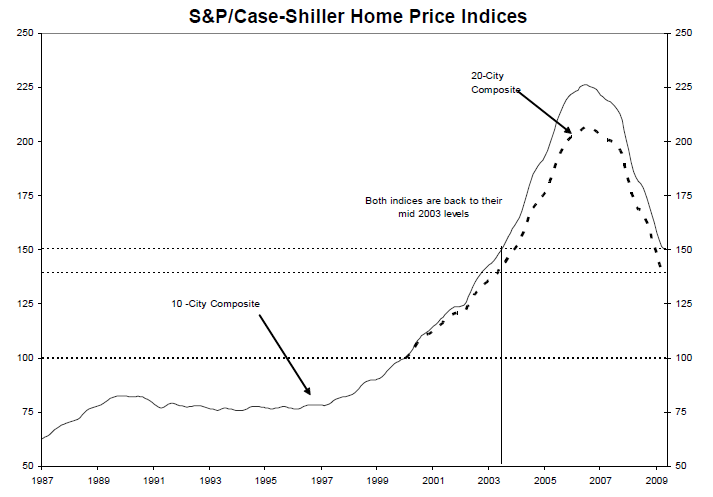

Home prices continued to decline in April 2009, but at a slightly less bad rate than expected.

Don’t break out the champagne, just yet.

The reduced collapse speed (another one of those famed 2nd derivatives) is primarily a function of foreclosure moratoriums. The overall trend in housing remains weak, with soft demand, excess inventory and heavily indebted consumer unlikely to effect a V-recovery.

That is before we consider the ongoing NFP job losses, which have been contributing to additional foreclosures.

And once the various government stimuli gets withdrawn — very low rates, $8,000 first-time home buyer tax credit — we can expect even these weak reports to turn south.

>

Source: S&P

What's been said:

Discussions found on the web: