Last week, we saw Continuing Claims decrease — proof, said the green shooters, of the imminent economic recovery.

Only, not so much:

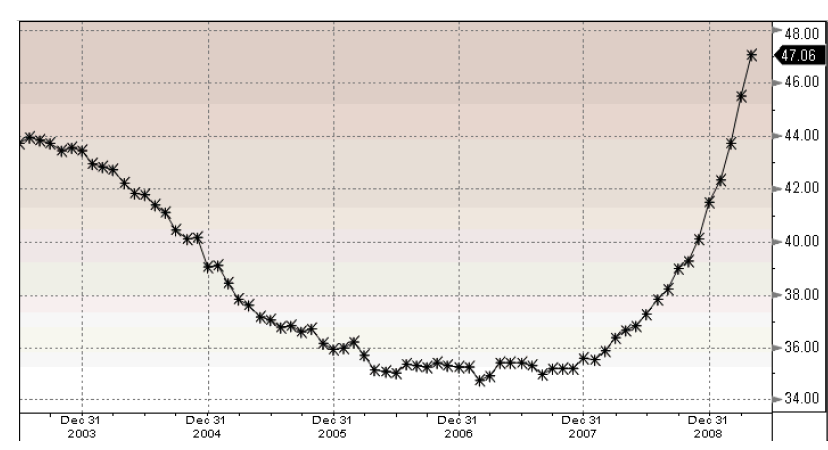

Those of you (who can still afford the luxury of) a trusty Bloomberg will note the ‘exhaustion rate’ for jobless benefits – EXHTRATE — reveals that people are not leaving the pool of continuing unemployment claims because they are getting new jobs; Rather, they are leaving because they have exhausted their benefits.

They are now unemployed AND broke. That is hardly a green shoot . . .

>

Exhaustion Rate: U.S. Workers Losing Unemployment Aid

Hat tip Bill King

What's been said:

Discussions found on the web: