>

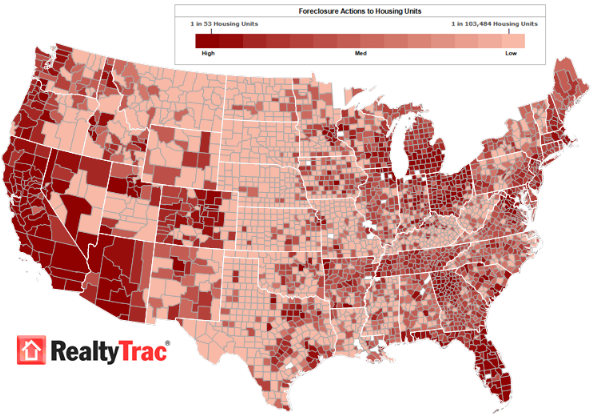

US Foreclosure filings (default notices, scheduled auctions and bank repos) were 321,480 U.S. properties during May 2009. Total foreclosures from April 2009, however, decreased 6%.

One in every 398 U.S. housing units received a foreclosure filing in May, the third highest month on record.

RealtyTrac said they expect REO activity to “spike in the coming months as foreclosure delays and moratoria implemented by various state laws come to an end.”

>

Source:

U.S. FORECLOSURE ACTIVITY DECREASES 6 PERCENT IN MAY

RealtyTrac, June 11, 2009

http://www.realtytrac.com/ContentManagement/PressRelease.aspx?channelid=9&ItemID=6655

See also:

U.S. Foreclosure Filings Top 300,000 as Bank Seizures Loom

Dan Levy

Bloomberg, June 11 2009

http://www.bloomberg.com/apps/news?pid=20601103&sid=aHEpXU3Pg_oU

What's been said:

Discussions found on the web: