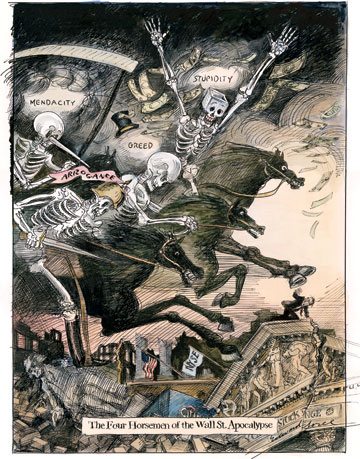

I really liked the Four Horsemen illustration that accompanied Joseph Stiglitz’ column in Vanity Fair this month — Greed, Mendacity, Stupidity and Arrogance:

>

>

Source:

Wall Street’s Toxic Message

Joseph E. Stiglitz

Vanity Fair, July 2009

http://www.vanityfair.com/politics/features/2009/07/third-world-debt200907

What's been said:

Discussions found on the web: