I just love this info/chart porn:

>

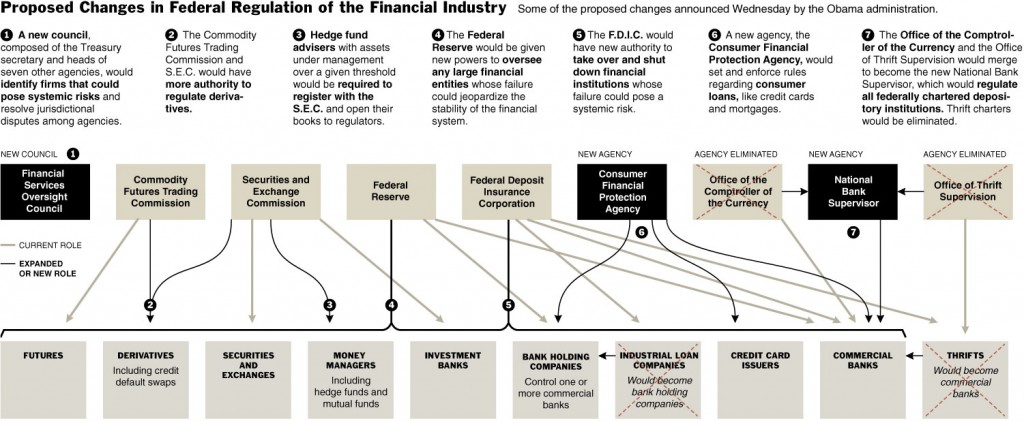

Proposed Changes in Federal Regulation of the Financial Industry

click for ginormous graphic

via NYT

>

Source:

Some Lawmakers Question Expanded Reach for the Fed

STEPHEN LABATON

NYT, June 17, 2009

http://www.nytimes.com/2009/06/18/business/18regulate.html

What's been said:

Discussions found on the web: