I have repeatedly mentioned Too Big To Succeed as a cause of the most recent crisis, but have you ever wondered HOW we got that way?

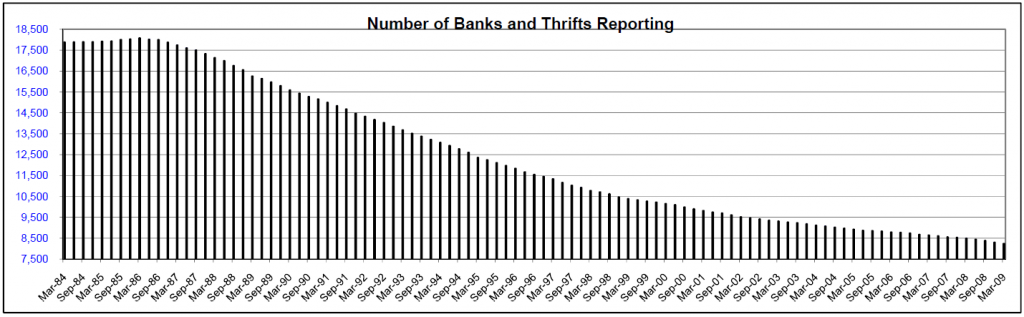

One obvious suspect has been the easy M&A environment of the past 20 years. Instead of a very competitive market where mergers for sheer size sake is discouraged, the opposite occurred. The number of bank acquisitions skyrocketed, and the number actual banks got slashed. Where there were once over 18,000 banks in early 1980s, today, the number is less than half, to under 8,500.

Recall that the big acquisitions and mergers in the 1980s were so banks could be competitive with Sumitomo and Mitsubishi and other big Japanese banks. (Why was that again?)

Hence, we end up with a few Superbanks. Ask yourself why Citibank (C), Bank of America (BAC), Washington Mutual (JPM), and Wachovia (WFC) got to be too large to manage. And once again, I am compelled to ask why it is in the country’s interest that 65% of the depository assets are held by only a handful of banks.

To put this into context, consider the chart below, courtesy of banking analyst Dick Bove:

>

What's been said:

Discussions found on the web: