We have a bull market excess stupidity.

Now that I think about it, this could very well be the longest bull market in history, running as it has for several 100,000 years.

The latest manifestation of this intellectual failure is the new government proposals to ban or radically restrict short selling.

Of all the anti-free-market proposals out there, turning equities into a one way bet is by far the least defendable, most ignorant, most damaging to the markets we have seen.

NYT excerpt:

“They have been reviled as the bad hats of Wall Street, nefarious traders who cashed in on the market collapse and, some insist, helped precipitate it. Now short-sellers, the market skeptics who correctly called last year’s downturn, are coming under even more unwanted scrutiny, this time from federal regulators. The Securities and Exchange Commission appears poised to reverse itself and reinstate rules that would make shorting stocks — that is, betting their prices will decline — somewhat more difficult.

Whether the S.E.C. will go far enough to satisfy the many critics of short-sellers is far from certain. The controversial role of these investors has divided not only the financial industry, but also federal regulators. As the S.E.C. considers its options, the debate is heating up. Hedge funds and big pension funds argue that short-selling is vital to modern markets. Such trading not only enables investors to hedge their risks but also to ferret out weak companies or, as in the case of Enron, outright frauds.”

Short sellers are the messengers, and they tell the story of fraud, over-valuation, and irrational exuberance. They also act as a good counter balance to the Street’s inherent cheerleading. Short seller Jim Chanos explains why the SEC should not further restrain Short Selling in some recent commentary (Letter tp the SEC is here).

One of the factors that the lawyers at the SEC don’t understand is the importance short sellers play in cushioning collapses. A brief excerpt from Bailout Nation:

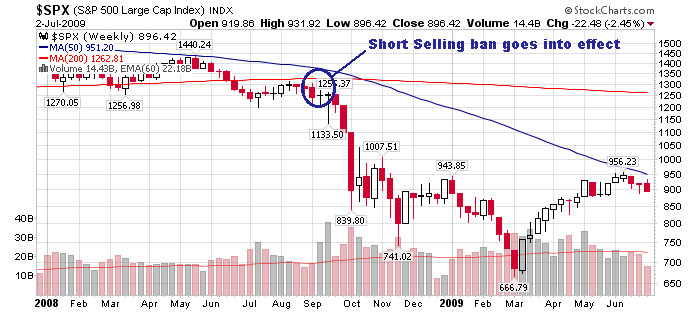

“In September 2008, with the crisis in full flower, [SEC Chief Christopher] Cox made shorting financial stocks illegal. Apparently, he was unaware that fierce market sell-offs often end with short sellers covering their positions, locking in profits on their bearish bets. With short sellers out of the market, the downturn became even fiercer. From the market highs of October 2007, the S&P 500 and the Dow Jones Industrial Average were cut in half in 12 months. Much of the damage came after the no-shorting rule went into effect.”

Here is a chart of the S&P500, showing when the ban went into effect and the subsequent result. The ban did not cause the sell off, but it removed natural buyers from the process that could have cushioned the blow:

via StockCharts.com

>

Sources:

S.E.C. May Reinstate Rules for Short-Selling Stocks

GERRY SHIH

NYT, July 2, 2009

http://www.nytimes.com/2009/07/03/business/03shorts.html

SEC Should Not Further Restrain Short Selling

JAMES CHANOS, PRESIDENT OF KYNIKOS ASSOCIATES LP,

Thursday, July 02, 2009 at 06:11 PM EDT

http://watchingthewatchers.org/indepth/21546/why-sec-should-not-further-restrain

See Also:

Financial Detectives

http://www.financialdetectives.org/

Shorts Story

GENE EPSTEIN

Barron’s, July 6, 2009

http://online.barrons.com/article/SB124657282666888819.html

What's been said:

Discussions found on the web: