>

Foreclosures continue to rise. As CNN/Money wrote, “The foreclosure plague is not going away — it’s only getting worse.”

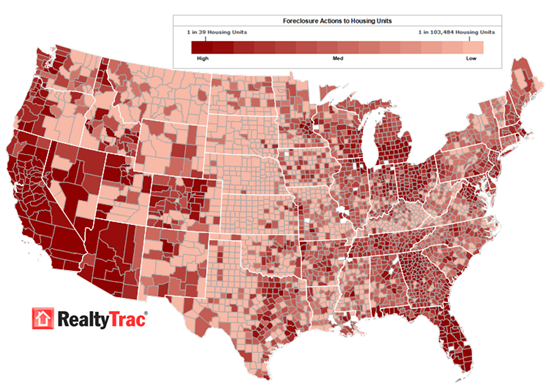

Here is the data on the first half of 2009, via RealtyTrac:

“Midyear 2009 U.S. Foreclosure Market Report, which shows a total of 1,905,723 foreclosure filings — default notices, auction sale notices and bank repossessions — were reported on 1,528,364 U.S. properties in the first six months of 2009, a 9 percent increase in total properties from the previous six months and a nearly 15 percent increase in total properties from the first six months of 2008. The report also shows that 1.19 percent of all U.S. housing units (one in 84) received at least one foreclosure filing in the first half of the year.”

No real estate bottom in sight . . .

>

Source:

1.9 MILLION FORECLOSURE FILINGS REPORTED ON MORE THAN 1.5 MILLION U.S. PROPERTIES IN FIRST HALF OF 2009

RealtyTrac

http://www.realtytrac.com/ContentManagement/PressRelease.aspx?channelid=9&ItemID=6802

ForeclosurePulse

http://www.foreclosurepulse.com/blogs/mainblog/archive/2009/07/15/foreclosure-filings-in-the-millions-midway-through-2009.aspx

What's been said:

Discussions found on the web: