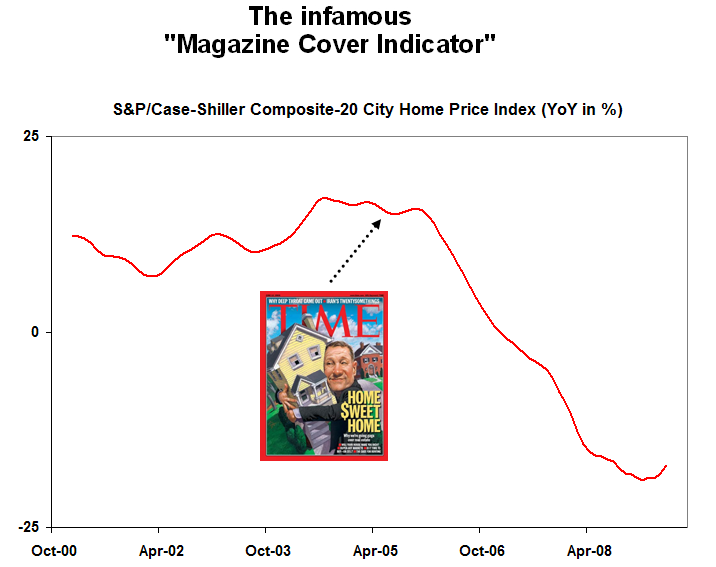

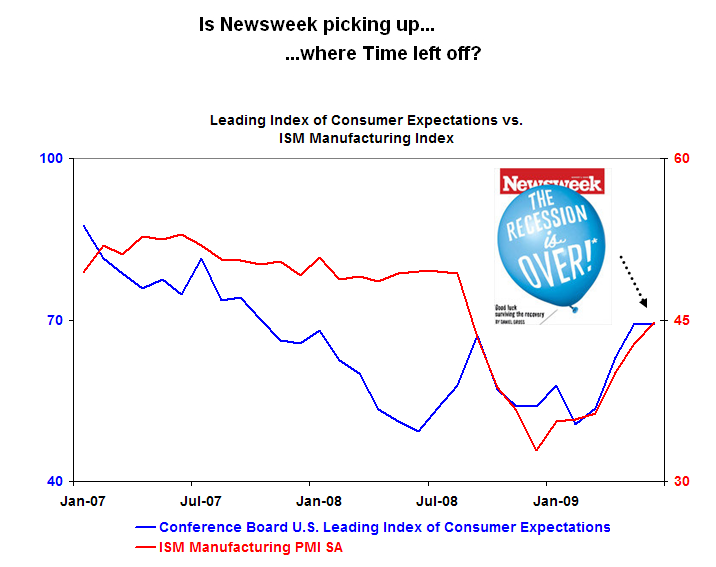

Mike Panzner sends along these 2 charts — and magazine covers — and wonders what they might mean:

>

>

>

The contrary read to the Newsweek piece is that the Recession isn’t over.

There is a sleight caveat with the Newsweek cover: The author of the Newsweek piece is Dan Gross, who is no stranger to contrary indicators and/or bubbles. He wrote a few books (Popped! Why Bubbles Are Great for the Economy and Dumb Money) and has been pretty savvy about the current state of affairs.

Note the Asterisk on the inflating “Recession is Over.” Its states “Good Luck Surviving the Recovery.”

>

Click for full size Newsweek Cover

What's been said:

Discussions found on the web: