Get ready for another round of bad reporting:

The $8,000 Fed tax credit (1st time buyers) and a $10,000 California tax credit (new homes only) likely helped out in NHS this month. Falling prices are also contributing to sales activity of the sector, which represents about 15% of the overall housing market.

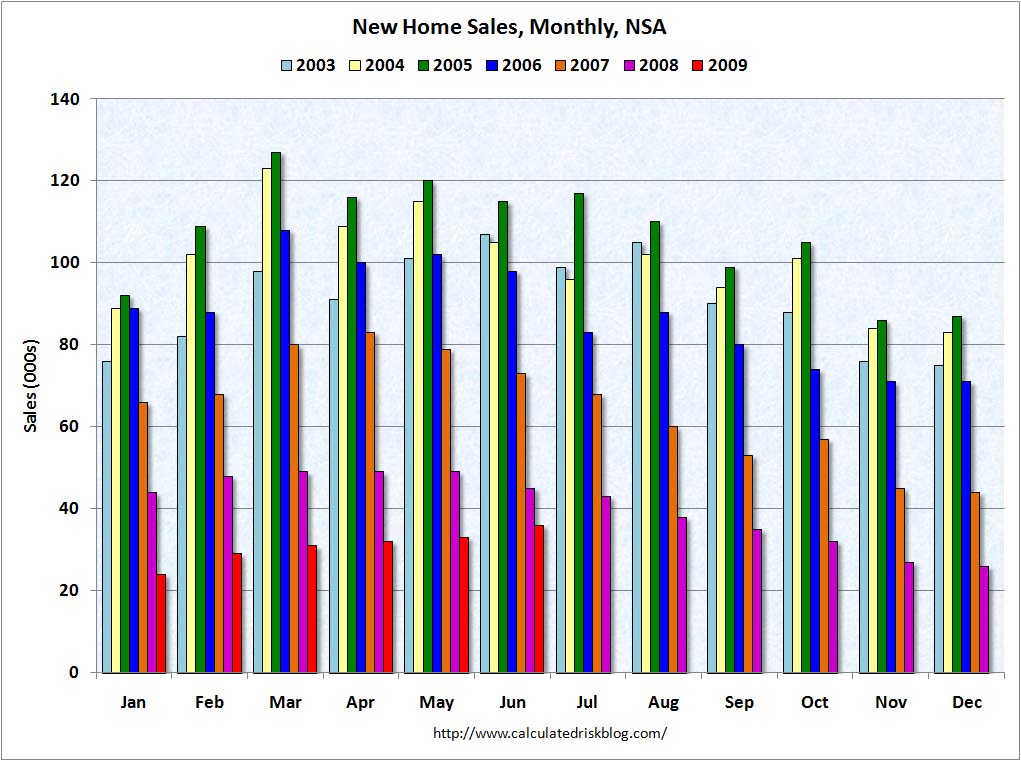

Here is the official New Home Sales:

Sales of new one-family houses in June 2009 were at a seasonally adjusted annual rate of 384,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.0 percent (±13.2%)* above the revised May rate of 346,000, but is 21.3 percent (±11.4%) below the June 2008 estimate of 488,000.

Thus, we in fact know that Sales fell from last year. They were down 21.3%, a number greater than the margin of error.

The monthly data, on the other hand, is not statistically significant. Therefore we DO NOT KNOW what the change was from last month, as the margin of error is greater than the reported data point.

The usual suspects got it wrong, as they do every month.

If New Home Sales are so strong, then can anyone explain why prices are still plummeting? Median home prices dropped 12% year-over-year, and 5.8% from the prior month.

>

Chart via Calculated Risk

>

Previously:

New Home Sales Data: Don’t rely On It Either (November 30th, 2005)

http://www.ritholtz.com/blog/2005/11/new-home-sales-data-dont-rely-on-it-either/

Source:

NEW RESIDENTIAL SALES IN JUNE 2009

Census, HUD, JULY 27, 2009 AT 10:00 A.M. EDT

http://www.census.gov/const/newressales.pdf

What's been said:

Discussions found on the web: