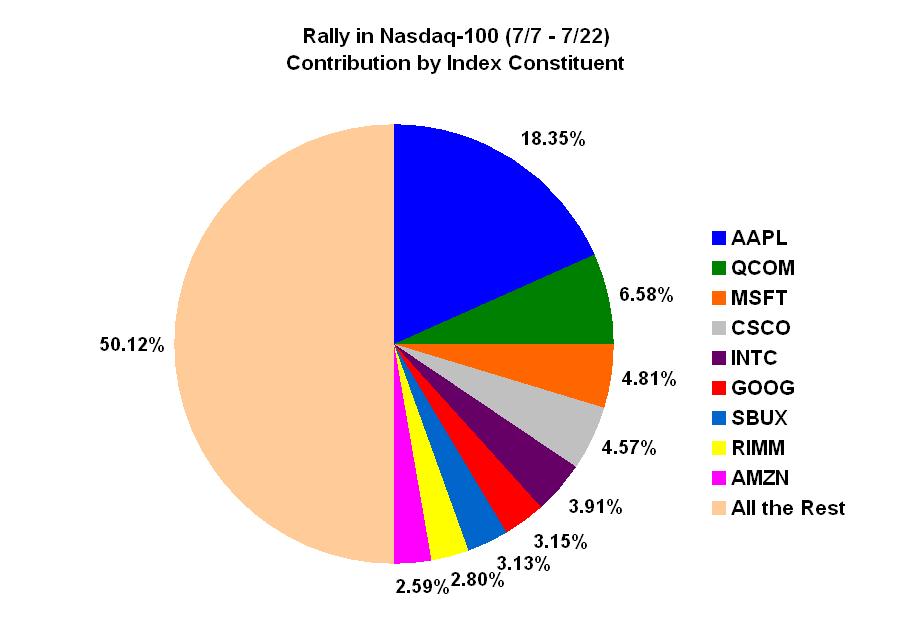

Although the U.S. equity market has had an impressive run since the July 7th lows, what many investors might find less-than-reassuring is how narrow the advance has been.

In the Nasdaq-100 index, for example, one stock, Apple, accounts for nearly one-fifth of the 11-percent gain. It has also pulled much more than its already hefty weight in the index. Otherwise, just nine stocks are responsible for more than half the move in the technology-laden bellwether.

While that doesn’t mean the rally can’t carry on, it’s another reason to be cautious on reading too much into the advance we’ve seen so far.

>

| Symbol | Name | 7/7/2009 Close | 7/22/2009 Close | Net Change in Points | Net Change in % | % of Overall Move in NDX | % Weight in NDX | Cumulative % of Overall Move |

| NDX | Nasdaq 100 Stock Indx | 1404.78 | 1565.00 | 160.22 | 11.41% | |||

| AAPL | Apple Inc | 135.40 | 156.74 | 21.34 | 15.76% | 18.35% | 13.97% | 18.35% |

| QCOM | Qualcomm Inc | 43.68 | 48.45 | 4.77 | 10.92% | 6.58% | 6.83% | 24.93% |

| MSFT | Microsoft Corp | 22.53 | 24.80 | 2.27 | 10.08% | 4.81% | 5.36% | |

| CSCO | Cisco Systems Inc | 18.24 | 21.45 | 3.21 | 17.60% | 4.57% | 3.16% | |

| INTC | Intel Corp | 16.25 | 19.14 | 2.89 | 17.78% | 3.91% | 2.65% | |

| GOOG | Google Inc-Cl A | 396.63 | 427.69 | 31.06 | 7.83% | 3.15% | 4.44% | |

| SBUX | Starbucks Corp | 12.97 | 17.39 | 4.42 | 34.08% | 3.13% | 1.23% | |

| RIMM | Research In Motion | 66.36 | 73.50 | 7.14 | 10.76% | 2.80% | 2.93% | |

| AMZN | Amazon.Com Inc | 75.63 | 88.79 | 13.16 | 17.40% | 2.59% | 1.80% | 49.88% |

>

What's been said:

Discussions found on the web: