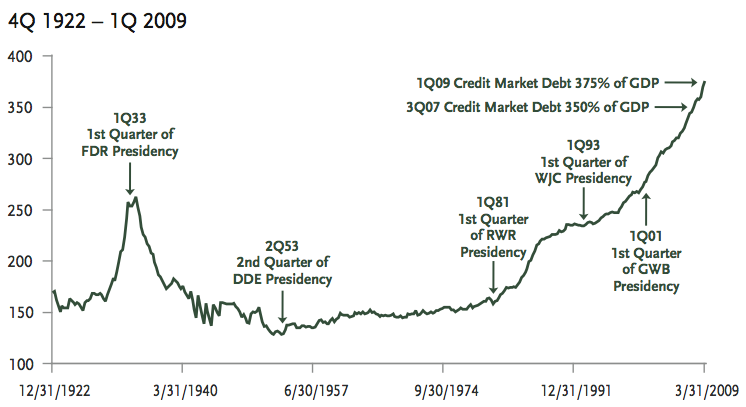

Fascinating analysis from Jeffrey Gundlach, Chief Investment Officer from TCW, titled The Jalopy Economy. Jeff places much of the blame for the nation’s current woes on our addiction to credit — a “Great Debt Binge — A Tragedy in 3 Acts.”

The chart is especially telling:

>

Total Credit market Debt as a % of US GDP

chart courtesy of TCW

>

Excerpt:

Once upon a time, not really very long ago, the world was a simpler place. There was self-sufficiency. Men could fix their own cars. And a loud whine from the gearbox warned the driver to replace its crudely milled gears before they failed completely. Today the racket from America’s financial gearbox is earsplitting, but unlike Grandpa, our government has chosen to forego repairs. Instead, Washington is acting like an “Honest John” car dealer from those old days. Back then, stuck with a beater with a noisy transmission, a bad dealer would pack the gearbox with extra-heavy lube, sometimes mixing in sawdust. The thickened gel would quiet the gears long enough to sell the car off the lot. The buyer wouldn’t notice a thing – until a week or so when the transmission burned out for good.

The financial breakdown of 2007-2008 marked a bursting of America’s long-running debt culture. Now Washington is trying to “solve the problem” with much more of the same: a massive upsizing of deficit spending combined with unprecedented monetary stimulus. These measures amount to the economic equivalent of a lube-and-sawdust fix. The fundamental gear works needed to honor America’s IOUs are stripped. On its present trajectory, our economy cannot honor its existing IOUs, let alone pay back a further build-up in future claims. The new debt binge might buy a little time, maybe even a spell of economic growth. But once the gears churn up the lube and sawdust, the old jalopy will grind to a stop. Then we will witness the sequel to 2007-2008. All this implies a range of default and inflation scenarios; the task before us is to prepare for those possible outcomes.

Good stuff . . .

Hat tip Scott

>

Source:

The Jalopy Economy

Jeffrey Gundlach

TCW, 06/15/2009

http://www.tcw.com/cmRoot/Funds/CIOLetters/JGLetter_061509.pdf

What's been said:

Discussions found on the web: