I am especially pleased to introduce today’s Think Tank guest, Economist David Rosenberg of Canada’s Gluskin Sheff. For most of you, however, David needs no introduction: A 20 year veteran of the Street, David most recently was Merrill Lynch’s chief North American Economist, where he correctly warned about the Housing and Credit Collapse and Recession in advance.

With Non-Farm Payroll scheduled to be released tomorrow, the timing is perfect to hear some thoughts from David about Employment . . .

>

>

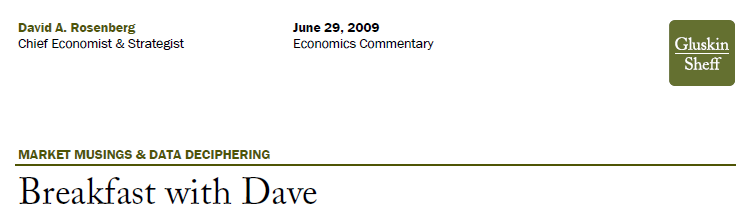

A survey conducted by YouGov for the Economist magazine found that 5% of respondents had taken a furlough this year and 15% had accepted a pay cut (see The Recession and Pay: The Quiet Americans on page 33 of this week’s edition).

As wages deflate, workers are looking for ways to supplement their shrinking income base, for example, by moonlighting. Indeed, a poll undertaken by CareerBuilder.com and cited in the USA Today found that one in every ten Americans took on an extra job over the last year; another one in five said they intend to do so in the coming year. These numbers are double for the 45 to 54 year olds who now see early retirement, once around the corner, as an elusive concept.

Most pundits who crow about green shoots and about an inventory restocking in the third quarter giving way towards some sustainable economic expansion live in the old paradigm. They don’t realize, for whatever reason, that the deflationary aftershocks that follow a post-bubble credit collapse typically last for 5 to 10 years. Businesses understand better than the typical Wall Street or Bay Street economist and strategist that everything from order books, to output, to staffing have to now be restructured to adequately reflect a permanently lower level of leverage in the economy.

Indeed, by our estimates, there is up to another $5 trillion of household debt that has to be eliminated in coming years and that process is going to require that consumers go on a semi-permanent spending diet. Companies see this, which is why they are not just downsizing their payroll, but have also cut the workweek to a record low of 33.1 hours. Fewer people are working and those that are still working have seen their hours dramatically cut this cycle.

Companies are finding other ways to save on the aggregate labour cost bill as well, which may be a factor reinforcing the uptrend in the personal savings rate (see more below). For example, a rapidly growing number of employers are now suspending contributions to worker 401(k) plans. According to a joint survey by CFO Research Services and Charles Schwab, nearly 25% of U.S. companies have either suspended their plans or are planning to do so (this is up from 2% at the turn of the year). Again, how we end up squeezing inflation out of the system when the labour market is clearly deflating wages and benefits for the 70% of the economy called the consumer is going to be interesting to watch.

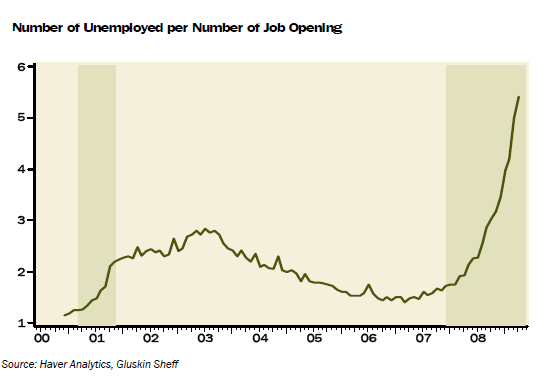

The op-ed column by Bob Herbert in the Saturday New York Times really hit the nail on the head on this whole ‘green shoot’ issue — how can there be ‘green shoots’ when the labour market is deteriorating at such a rapid clip fully nine months after the Lehman collapse. The full brunt of the credit collapse may be behind us, but please, the other two shocks, namely deflating labour markets and deflating home prices, are very much still front and centre. For every job opening in the USA, there are more than five unemployed actively seeking work vying for those jobs. That is unprecedented and nearly double what we saw at the depths of the 2001 recession. The official ranks of the unemployed have doubled during this recession to 14 million and if you take into account all forms of labour market slack, the unofficial number is bordering on 30 million, another record. For those who still believe that we somehow managed to avoid an economic depression this cycle because of a 13% fiscal deficit/GDP and a pregnant Fed balance sheet, the Center for Labour Market Studies at Northeastern University estimates that the real unemployment now stands at 18.2%, which is actually higher than the posted rate at the end of the 1930s.

WAGE DEFLATION IS A REALITY … FAR MORE IMPORTANT THAN THE CRB

AGAIN, HOW WE SQUEEZE INFLATION OUT OF THIS LEMON OF A LABOUR MARKET IS A VALID QUESTION.

When the recovery does come, the record number of people that have been pushed into part-time work are going to see their hours go back up, which will be good for them, but not so good for the 100,000 – 150,000 folks that will be entering the labour force looking for work with futility. The unemployment rate is probably going to rise through 2010, which is going to pose a challenge for incumbents seeking re-election in the mid-term voting season. It may also prove to be a challenge for Ben Bernanke’s re-appointment chances this coming February.

As we said above, companies have permanently reduced the size of their operations with the knowledge of how much credit is going to be available to them in the future to survive because the financial sector is going to be operating under more supervision and regulation and leverage ratios, which means the funds available to support a given level of GDP is going to be measurably smaller than what we had become accustomed to during the secular credit expansion, which really began in the mid-1980s, only to turn parabolic during the ‘ownership society’ era of 2002 to 2007.

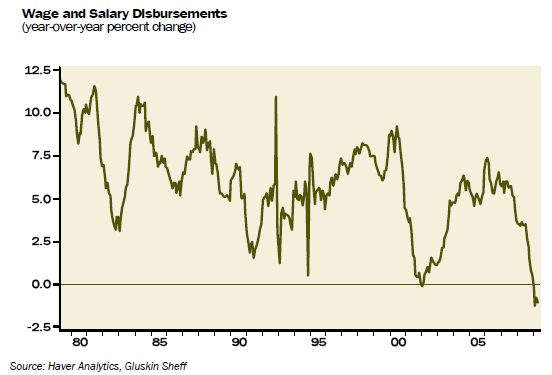

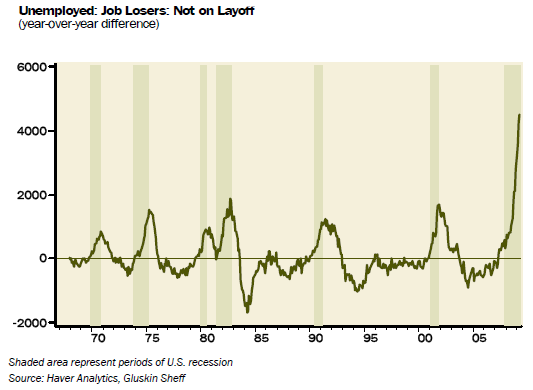

What makes this cycle “different” is that three-quarters of the workers that were fired over the last year were let go on a permanent, not a temporary basis. A record 53% of the unemployed today are workers who were displaced permanently — not just temporarily because of the vagaries of the traditional business cycle. This means that these jobs are not going to be coming back that quickly, if at all, when the economy does in fact begin to make the transition to the next expansion phase. In turn, this implies that any expansion phase is going to be extremely fragile and susceptible to periodic setbacks. There may well be job growth in the future in health care, infrastructure, energy technology and the like, but we can say with a reasonable amount of certainty that there are a whole lot of jobs in a whole lot sectors where jobs lost this recession are not going to come back. For example, the 580k jobs lost in financial services; the 320k jobs lost in residential construction; the 1.7 million jobs lost in durable goods manufacturing; the 1.1 million jobs lost in the wholesale/retail sector; and the 380k jobs that were lost in the leisure/hospitality industry. That is over four million jobs that were shed this cycle that are not likely to stage a comeback even after the recession is over. To show you how big a number four million is, we didn’t create that many jobs in the prior expansion until it reached its fourth birthday towards the tail end of 2005.

PERMANENT JOB LOSERS SURGE TO RECORD OF NEARLY 8 MILLION

PERMANENT JOB LOSERS SURGE BY 4.5 MILLION IN THE PAST YEAR

OVER HALF OF THE UNEMPLOYED NOW LONG-TERM

THE TRUEST PICTURE OF EXCESS LABOUR SUPPLY

>

As Bob Herbert points out in his article in the Saturday NYT, the unemployment rate for males has already soared to 10.5% whereas the rate for females is at 8.0% in the largest gender gap in favor of women since World War II. Has anyone worked through the sociological repercussions from this divergence on divorce rates, birth rates, even crime rates?

Moreover, since employers are favouring experience over youth, and because the savings-constrained folks over the age of 55 are getting whatever jobs there are out there, a massive pool of joblessness has been created this cycle among the younger-age cohorts where the unemployment rate for 20-24 year olds has surged to 15.0% (and 23.0% for 16-19 year olds). This, too, will have social implications going forward. As Lawrence Mishel, president of the Economic Policy Institute was quoted as saying in the Bob Herbert column, “I believe this is going to leave a permanent scar on a generation of kids”. Work habits and experience are honed when people are in their 20’s and this is the generation that is being most affected by the shrinking demand for labour — and this is going to lead down the road to a slower trend in structural productivity growth.

Quite frankly, we cannot imagine a more difficult environment for the stock market — the impact on both corporate earnings and fair-value estimates for the P/E multiple — than a backdrop that includes a permanently lower level of potential GDP growth alongside a record output gap. What that means is much lower volume growth and much lower pricing power over the next five to 10 years. This means that bear market rallies will come, as we have already seen repeatedly in the last two years with an obvious exclamation mark on the one posted from March 9 to May 4 … and they will go.

It is amazing how many pundits and media types believe we are in a new bull phase and yet the equity market has completely sputtered now for nearly three months above the 900 level on the S&P 500 and 8,400 on the Dow — not to mention the fact that instead of seriously breaking out above the 200-day moving average, the broad market has been struggling at this resistance level for the last few weeks, which is a sign that buying fatigue has likely set in (together with meager trading volumes).

It may well be true that the University of Michigan Consumer Sentiment index improved in June to 70.8 from 68.7 in May, but not every confidence measure showed ebullience last month. The Rasmussen index averaged 73.1, down from 74.1 in May, and the ABC News/Washington Post consumer comfort poll is sitting at -53 compared with -49 at the end of May and is a mere two points shy of hitting a new all-time low. Interestingly, the ‘personal finances’ subindex at -22 did hit a new record low and is worse now than it was back in mid-March when the equity market was cratering (was -4 at that time).

>

~~~

Founded in 1984 and focused primarily on high net worth private clients, Gluskin Sheff is dedicated to meeting the needs of our clients by delivering strong, risk adjusted investment returns together with the highest level of personalized service. The minimum investment required to establish a client relationship witjh Canadians with the firm is $3 million, and for US and International is $5 million.

For almost 25 years, Gluskin Sheff has pursued investment strategies that set us apart from other investment firms and currently manages investment strategies across equity, alternative and fixed income asset classes. Managing risk and ensuring adequate diversification are hallmarks of our investment philosophy. Customized investment plans are tailored around individual and evolving client needs.

“Our mission is to be the pre-eminent wealth management firm in Canada serving high net worth investors”

What's been said:

Discussions found on the web: