One of our longstanding complaints has been that the traditionally reported measure of Unemployment, U3, dramatically under-reports unemployment in America. It is far too narrow and ignores too many people that want to work full time, but cannot.

We have detailed this over the years, and last summer, modestly proposed the media begin reporting U6, the broadest measure of joblessness. (see Previously, below)

So you can imagine our pleasure when yet another MSM gets hip to this. In the rpesent instance, it is the New York Times, Part-Time Workers Mask Unemployment Woes:

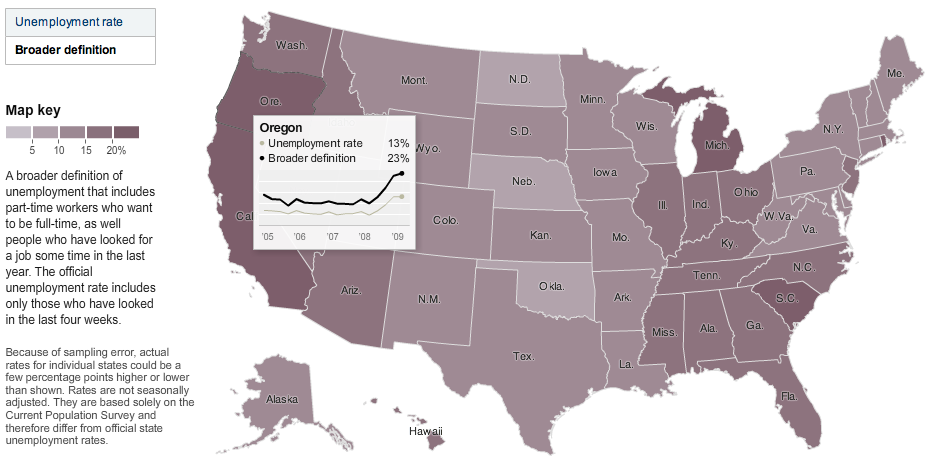

In California and a handful of other states, one out of every five people who would like to be working full time is not now doing so.

It is a startling sign of the pain that the Great Recession is inflicting, and it is largely missed by the official, oft-repeated statistics on unemployment. The national unemployment rate has risen to 9.5 percent, the highest level in more than a quarter-century. Yet it still excludes all those who have given up looking for a job and those part-time workers who want to be working full time.

Include them — as the Labor Department does when calculating its broadest measure of the job market — and the rate reached 23.5 percent in Oregon this spring, according to a New York Times analysis of state-by-state data. It was 21.5 percent in both Michigan and Rhode Island and 20.3 percent in California. In Tennessee, Nevada and several other states that have relied heavily on manufacturing or housing, the rate was just under 20 percent this spring and may have since surpassed it.

Of course, we also know from history that unemployment will continue to rise, even after the recession is officially over (so we got that going for us, which is nice).

Surprisng to see Oregon with the worst Unemployment in the nation — I would have guessed Michigan.

>

Click for interactive graphic

>

>

Previously:

A Closer Look at Unemployment (September 2007)

http://www.ritholtz.com/blog/2007/09/a-closer-look-at-unemployment/

Unemployment Reporting: A Modest Proposal (U3 + U6) (June 2008)

http://www.ritholtz.com/blog/2008/06/unemployment-reporting-a-modest-proposal-u3-u6/

Pervasive Pollyannas of Prosperity (July 2008)

http://www.ritholtz.com/blog/2008/07/pervasive-pollyannas-of-prosperity/

NFP: Even Worse Than Reported (December 8th, 2008)

http://www.ritholtz.com/blog/2008/12/nfp-even-worse-than-reported/

Persons “Marginally Attached to the Labor Force” (July 4th, 2008)

http://www.ritholtz.com/blog/2008/07/persons-marginally-attached-to-the-labor-force/

Source:

Part-Time Workers Mask Unemployment Woes

DAVID LEONHARDT

NYT, July 14, 2009

http://www.nytimes.com/2009/07/15/business/economy/15leonhardt.html

What's been said:

Discussions found on the web: