The one question I seem to get more than any is on (Hyper) Inflation versus Deflation. As previously noted, we clearly are in a Deflationary party of the cycle now.

While inflation may occur ion the future, and the possibility exists for Hyper-Inflation, these are merely potential issues down the road.

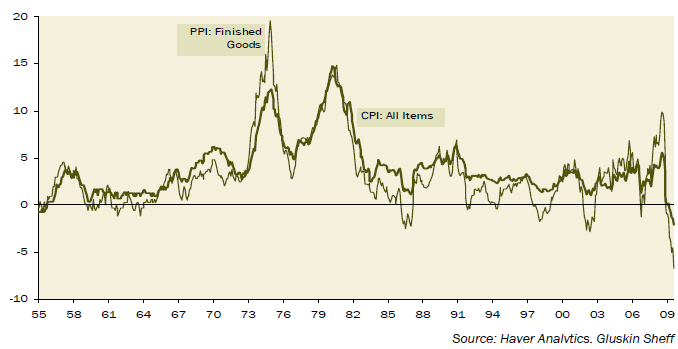

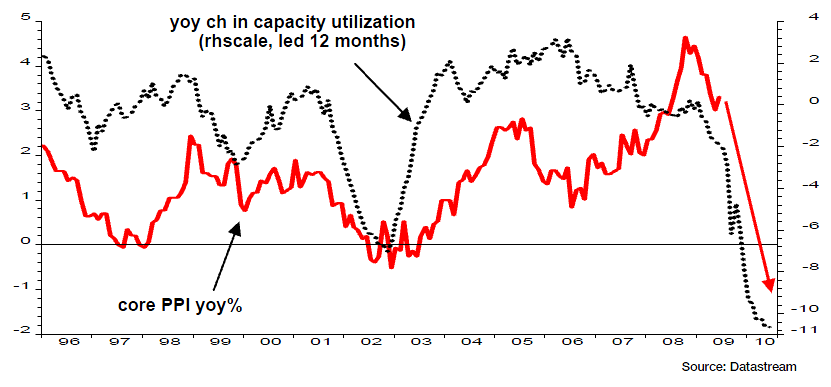

As these two charts show, we now have Deflation, are likely to see it continue for some time into the future:

>

Near Record Deflation Rates At All Levels

>

What's been said:

Discussions found on the web: