Interesting piece from Deutsche Bank on rapidly deteriorating Construction loans. DB predicts that “construction loans will be the epicenter of bank loan problems”

• By far the riskiest type of loan product in bank portfolios;

• Substantial portion represents loans to homebuilders;

• Market currently penalizing properties with vacancy issues extremely severely;

• Newly constructed (or only partially constructed) properties are the poster children for vacancy problems in CRE;

• Values of most newly constructed properties are down massively;

• Expect extremely high default rates and extremely high loss severity rates, both likely to be in excess of 50%;

• Total expected losses of 25% or more.

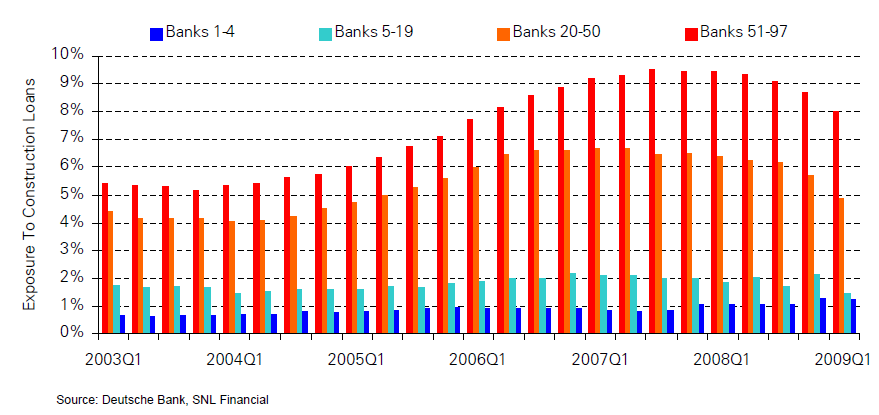

In a reversal of the Residential Real Estate market, the exposure for large money center banks is low — smaller regional and community banks have the highest construction loan exposure.

>

Construction loan exposure for smaller banks has nearly doubled since 2004

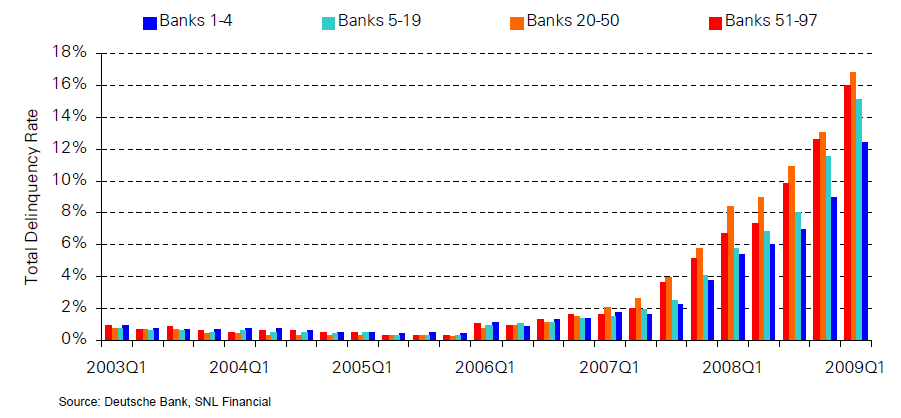

Construction loans are structured with upfront reserves — meaning that it takes much longer for CRE defaults to occur. Low short-term interest rates also means reserves can last longer — BUT, as DB notes, Once reserves are exhausted, defaults will skyrocket.

>

The current delinquency rate is 15%, but may head much higher

>

Source:

The Outlook for CRE and Its Impact on Banks

Richard Parkus

Deutsche Bank, 30 July 2009

http://gm.db.com/IndependentResearch

What's been said:

Discussions found on the web: