The details on exhaustees — the people have used up their total Unemployment benefits — are pretty daunting. I mentioned this to Doug Kass last week, who referenced our prior post on the subject at Real Money, and it caused quite a stir.

Let’s explain what this means and update a chart on the subject.

If you lose your job, you get Unemployment Benefits, an insurance program that you pay into so long as you are getting a salary. After 26 weeks, you will exhaust those benefits and become an exhaustee.

But, wait, there’s more!

These days, via the stimulus plan, we have the Emergency Unemployment Compensation (EUC) which is good for 20 weeks. Then, there is the Supplemental EUC, which depending upon what your state thinks of the Federal largesse of handing out money to the recently unemployed, ranges anywhere from 13 to 20 more weeks.

The most recent data run was for the week of July 11. As of that week, the Extendees — which consists of soon-to-be-Exhaustees — gained 25k, raising the total unemployed receiving extended benefits to about 2.66 million people. One year ago, there were only 127 thousand receiving extended benefits.

And, as the NYT noted yesterday, there are another 1.5 million people likely to become Exhaustees over the next few months. . . .

>

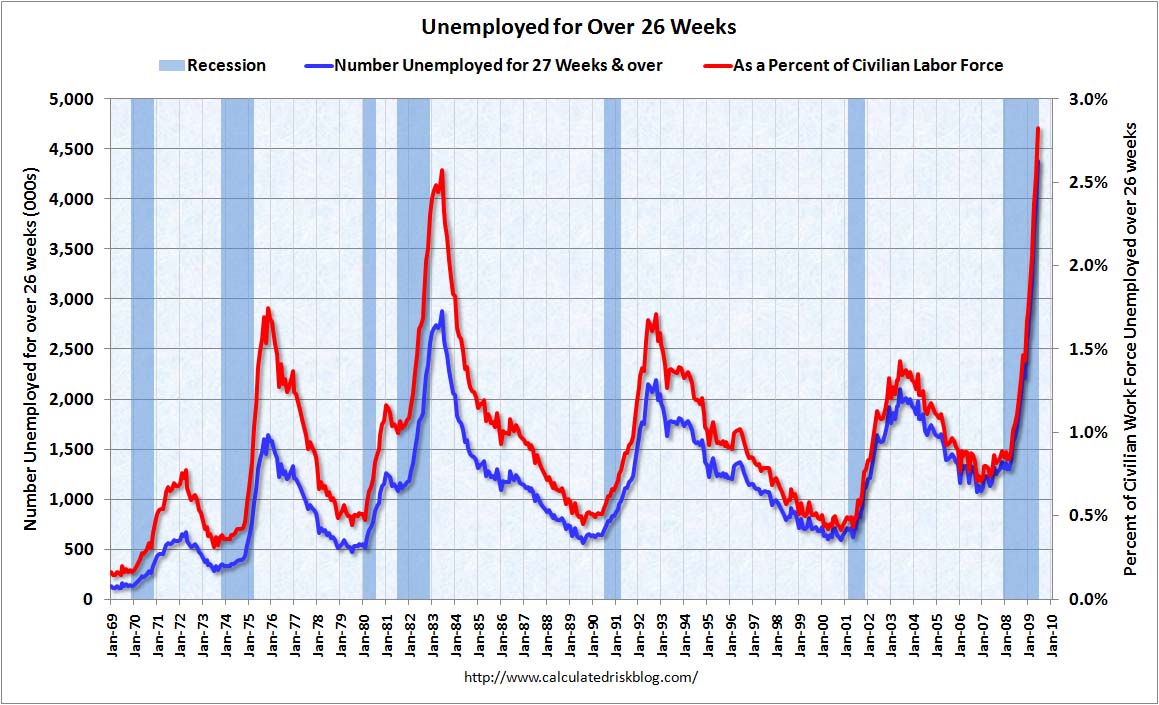

Nice graphic from Calculated Risk showing how severe this is:

>

>

Previously:

Continuing Claims “Exhaustion Rate” (June 22nd, 2009)

http://www.ritholtz.com/blog/2009/06/continuing-claims-exhaustion-rate/

Continuing Claims vs. Economically Lagging Unemployment (May 10th, 200)

http://www.ritholtz.com/blog/2009/05/continuing-claims-vs-economically-lagging-unemployment/

Source:

Prolonged Aid to Unemployed Is Running Out

ERIK ECKHOLM

NYT August 1, 2009

http://www.nytimes.com/2009/08/02/us/02unemploy.html

What's been said:

Discussions found on the web: