The latest housing consensus as sung in three part harmony amongst the media and green shoots crowd. Their song goes something like this:

1) The worst of the housing trouble is now behind us;

2) Only recently, Housing was “Getting worse more slowly;”

3) That has transitioned to “Housing is getting better.”

I don’t believe it. IMO, all 3 are misleading or outright wrong. This post explains why.

On Friday, the market rallied smartly — and while expiry had something to do with it, the larger part of the gains came after the release of the Existing Home Sales data. Traders’ kneejerk reaction seemed to reflect the belief that not only is the worst of Housing now behind us, but that Housing was actually getting better.

Indeed, Housing is going to be a growth driver for the economy going forward!

Only, not so much. A close look at the data reveals this to be a false premise. If you only read the NAR spin, its easy to fall into their web of happy talk. (We’ve said it so many times, it still bears repeating: The National Association of Realtors are a highly misleading news source. Look past what they say to the actual numbers if you seek economic truth).

In the past, I have gone so far as to imply the Realtors group are spinmeisters. This month, I will be more blunt: Their actual data has become untrustworthy, their spokesmen lie for a living, and their “news releases” is little more than misleading junk.

Investors who rely on the NAR version of the news do so at their own great financial peril.

Witht hat intro, lets dig intot he actual data to show why the real estate trade group happy talk is misleading bunk. IF YOU ARE INTERESTED IN HOUSING, then you need to thoroughly fisk the NAR data, put it into context, and strip the lipstick off the pig.

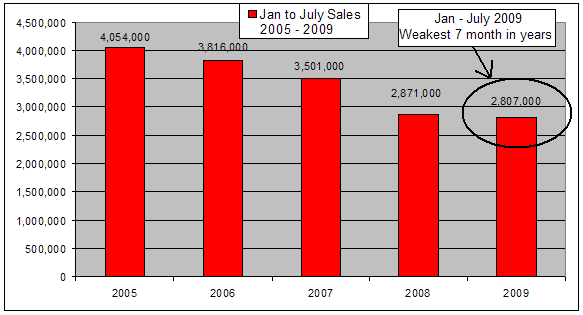

Let’s do just that: A closer look at the actual unspun data reveals the NAR fantasies. Rather than recently improving, we see that January to July 2009 is actually the weakest 7 month period in 5 years — since the market topped in ’05.

Let’s do just that: A closer look at the actual unspun data reveals the NAR fantasies. Rather than recently improving, we see that January to July 2009 is actually the weakest 7 month period in 5 years — since the market topped in ’05.

Consider Mark Hanson’s analysis: He points out that “If not for a surprise and suspect 16k increase in Northeast condo sales, Existing Home Sales would have been lower month-over-month and only up 12k units from July 2008, which was the worst year on record for housing.”

Let’s see what happens if we back out those condo sales to look at just Single Family Homes ex Condos — which accounts for the vast majority of the US housing market. We see a very different picture. Existing home sales (ex-Condos) were down 10% from July 2007, flat from July 2008, and off 5% from June 2009.

Hence, the boom in cheap Northeast condo units accounted for all of the excitement in Friday’s EHS release. Indeed, the overall UNADJUSTED data shows not only that housing is not getting better, it is still getting worse.

Let’s go back to the NAR release. As noted on Friday, on a NON-seasonally-adjusted basis, existing home sales were nowhere near as strong as advertised. According to M Hanson Advisors:

“Even with condos included, the all-important Western Region was down 10% m-o-m. It is consensus that the housing market in the West is booming. While sales are booming at low end, I have argued for months that demand from first-timers and investors was at peak levels and July’s results prove this.Such weak results m-o-m and relative to 2008 underscore how critically injured the housing market remains.

Think about it…prices are down sharply y-o-y; rates are at historic lows; moratoriums and modification initiatives have kept hundreds of thousands of foreclosures off the market; housing sentiment is worlds better; a tax credit is available; and still, y-o-y sales are flat for all intents and purposes and down 6.5% from weak 2007 levels when pricing was near the peak. Conditions won’t get much better than this in the future — what is it going to take to sell houses?

This confirms my prior view that there are a lot of federal forces focused mightily to merely maintain housing in a gentle downdraft. But for this extraordinary government intervention, Housing would actually be much much worse. Foreclosures would be driving prices much lower — a good thing IMO, as it would hasten the cleansing of the boom’s excesses.

Recall that as the market topped out in 2005-06, cheaper Condo sales became a disproportionate source of total volume, as struggling buyers ran low on both cash & credit and were forced to move downstream.

That is now replaying over again. Perhaps its a sign of tight credit conditions or retiring boomers downsizing. Regardless, the mix of condos to single family homes is especially noteworthy.

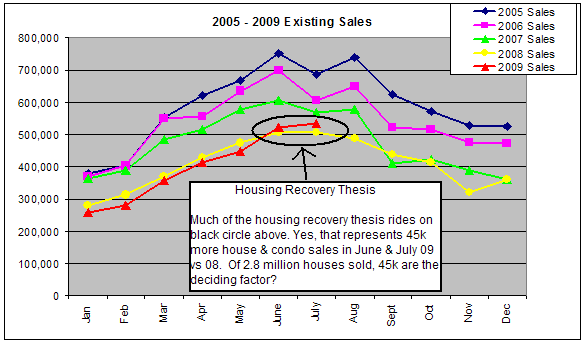

Have a look at the chart below, which Hanson rolled out to show the impact Condos have had on the overall Housing sales:

>

Existing Home Sales, NSA, 2005-09

chart courtesy of M Hanson Advisors

>

We see above that in 2009 (red line) Sales were behind 2008 (yellow line) until June/July. That is when we jumped 45k in sales ahead of last year — Out of 2.8 million housing units sold.

But as Hanson writes:

“Look at what was thrown at it in order to get this rounding error. We have thrown in over a trillion dollars to buy rates down, countless $8k tax credits, mortgage mods, foreclosure moratoriums plus hundreds of billions more, and it only bought 45k yoy additional sales over June & July combined. After a 50% to 70% price hit in the hardest hit areas — that are also the busiest now — only 45k sales out 2.8 million sold this year are responsible for the national consensus that housing has bottomed, which is the golden key to the consumer recovery spending chest.”

Remove government interventions, and the housing market collpase would continue unabated.

Finally, let’s look at one last factor: The impact of Foreclosures on Seasonal adjustments. We know that the NAR’s takes each month’s data, then runs it through their own meat grinder: They annualize the number, they hamhandedly seasonally adjust it, they do whatever they can to accentuate the positive, while ignoring some of the ugly context the data exists in.

Like Foreclosures.

Have a look at this chart — showing total sales, with foreclosures broken out.

>

Foreclosures as a Portion of Existing Home Sales

chart courtesy of M Hanson Advisors

>

The three part harmony that the consensus is singing is out of tune. While the very worst of housing trouble may be behind us, we are still looking at falling prices and increasing foreclosures. The Housing getting worse more slowly camp is ignoring the massive Federal subsidies required to get worse more slowly. As to “Getting better,” the data argues persuasively otherwise, and I will make appropriate bets against this viewpoint.

>

Special thanks to Mark Hanson for his assistance with this piece.

What's been said:

Discussions found on the web: