Today we will get a real test for whether the recent pullback is merely a buying opportunity, or the start of something more serious.

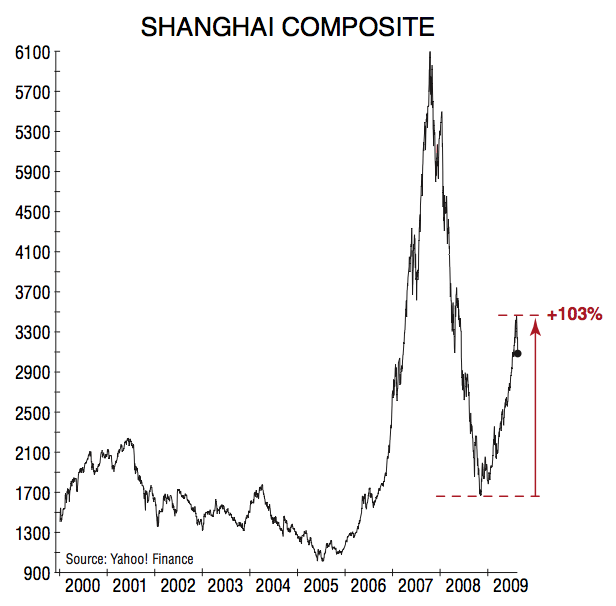

– Shanghai shares fall the most in 9 months, hitting a 2-month low;

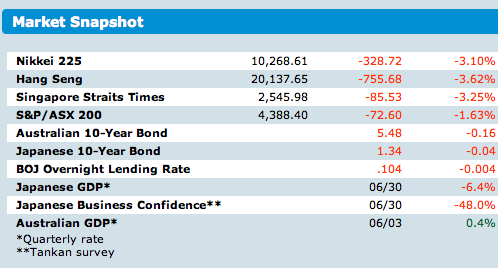

– Nikkei Index fell 3.1%;

– HK shares post biggest drop in 4-½ months;

– Hang Seng falls 3.6%;

– Oil, coal, metals stocks hit by lower commodity prices;

– Singapore dropped 3.2%.

Here is what the Shanghai Index looked like prior to today’s fall:

chart courtesy of Investech

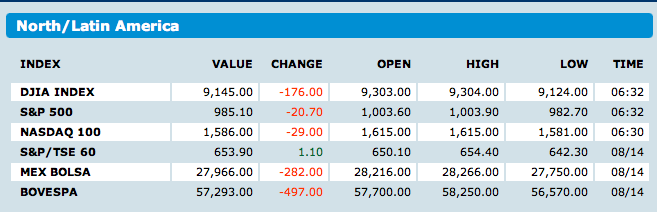

US Futures are down significantly:

Asian bourses fall:

What's been said:

Discussions found on the web: