I did not have time to take Friday’s BLS release apart until now — between the fishing and the drinking I am slacking off during my Maine trip — but it only took a cursory glance to see July NFP was not all it was cracked up to be.

This was the best employment number in 12 months — yet it was still a loss of 247,000 jobs. Under normal circumstances, this would an awful number. To put that into context, it would have been the worst month in mots of the recessions over the past 30 years. But after recent monthly NFP job losses of 650k and 700k, somehow 247k seems like good news. Its a classic case of been down so long it feels like up to me.

Let’s take a quick look beneath the headline job number and see what was really going on.

1) Unemployment: The fall from drop in the Unemployment Rate was hailed as a huge improvement by few pundits commenting on — before they had a moment to even read the release. Had they bothered to look at the releaser (crazy idea, I know) they might have learned how this data point is constructed.

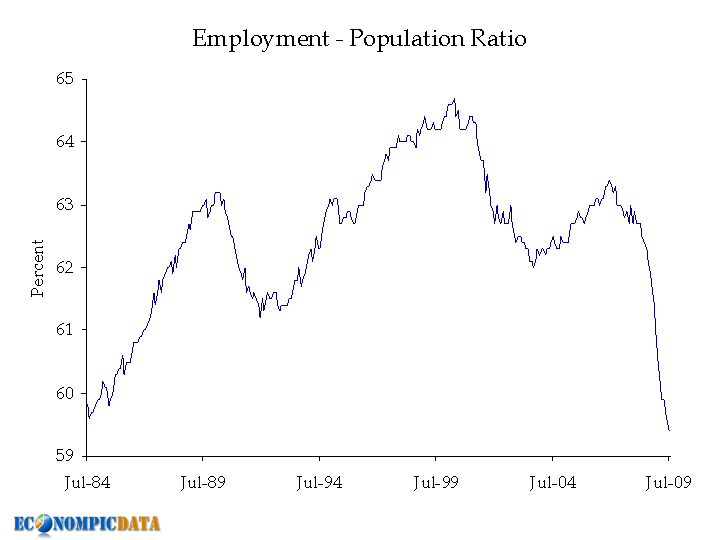

The participation rate fell by 0.2 point, and the employment/population ratio fell by 0.1 point — this is now at levels not seen since April 1984 (see chart below). NILFs — “not in the labor force” increased by a huge 637,000. Bruce Steinberg notes that those not in the labor force topped 81 million for the first time ever. That gain in NiLF accounted for the entire decrease in unemployment rate.

Here is how this works: There are two numbers that make up Unemployment — people who have jobs, and the Labor Pool. This month, the Unemployment rate went down because the Labor Pool contracted — not because more people found work.

A decreasing Labor Pool is often a negative, not a positive, economic signal. (Jake at Econompic does a nice job explaining how the math works).

As the chart below shows, the Labor Pool has been falling for quite some time:

>

Chart via Jake at Econompic

>

2) Mostly Government Sponsored Hiring: A large chunk of the moderation in job losses was directly due to government activity. The spurt in auto production (helped by GM and Chrysler calling back workers after emerging from bankruptcy) was a result of the a Billion already spent in Cahs for clunkers, and the prospect of another $2 billion yet to come. Add in federal government hires for census and others, and you effectively add 100,000 to the jobs count.

3) Wage Gains: David Rosenberg notes that the increase in average hourly earnings owed in part to the boost in the minimum wage, in other words a nonrecurring item that “does not at all reflect an improvement in underlying income fundamentals in the personal sector.”

Add in recalled workers in Autos and this element is nearly all Uncle Sam.

4) Seasonal Adjustments: John Williams of Shadow Stats observes that the improvement in second derivatives (the rate of change) is due to the way the decline’s severity perverts seasonal adjustments.

In particular, (1) Year-to-year comparisons will begin to see a flattening in annual declines, as year-ago numbers used in comparisons were in severe contraction. (2) Extreme economic disruptions have distorted patterns of regular activity and related seasonal-adjustment processes.

Williams notes that this upward seasonal adjusting bias has created unwarranted job gains in 10 of the previous 12 months that total over 1.1 million jobs.

~~~

One final observation on sentiment: Rosenberg was quoted in Barron’s this weekend, discussing how the market prices in bad news and occasionally manages to overshoot in each direction. He points to the unusual fact that since March, “for the first time ever, it has rallied nearly 50% amidst a two-million-job slide.”

That is a disturbing factoid, one that suggests a disconnect is taking place between equities and the real world. That wouldn’t be the first time this occurred. And when that disconnect gets too wide, as we have seen in the past, the market corrects, often violently.

September and October are but a few weeks away . . .

>

Sources:

Hair of the Dog

Alan Abelson

Barron’s AUGUST 10, 2009

http://online.barrons.com/article/SB124968366951515643.html

What's been said:

Discussions found on the web: