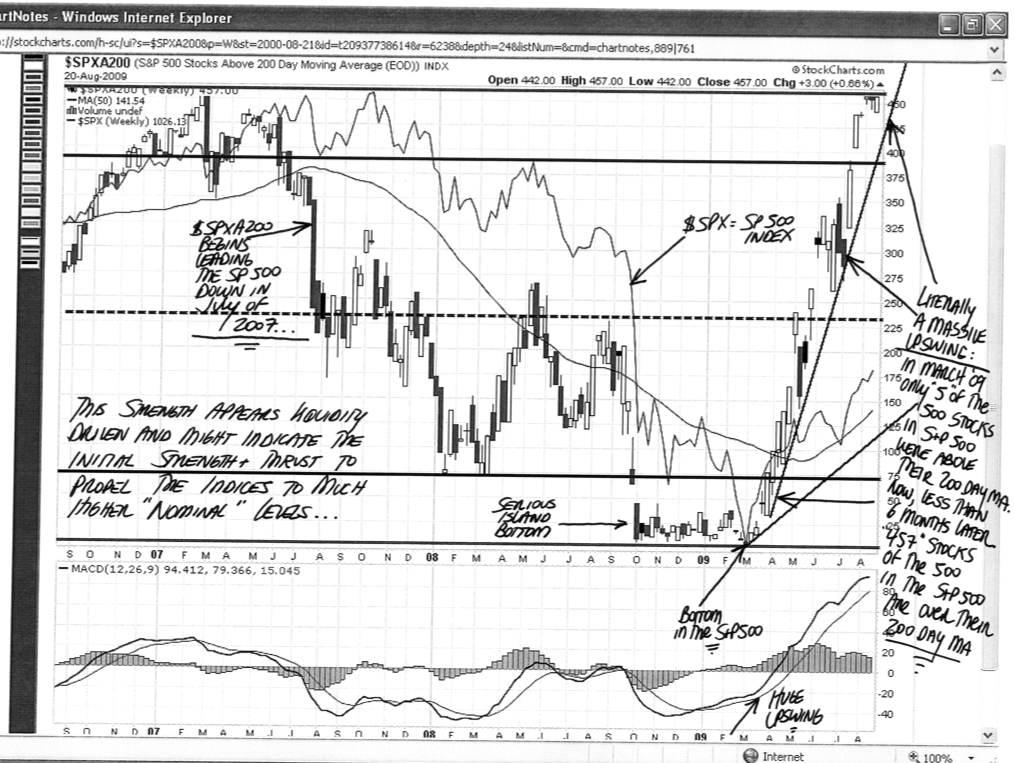

I really like the style of the David Singer’s handwritten annotations of this chart:

>

SPX Annotated

click for ginormous chart

PDF: DS’ Annotated SPX

>

Any thoughts on this ? I think stylistically its fresh, and David has been pretty sharp calling the very short term squiggles . . .

What's been said:

Discussions found on the web: