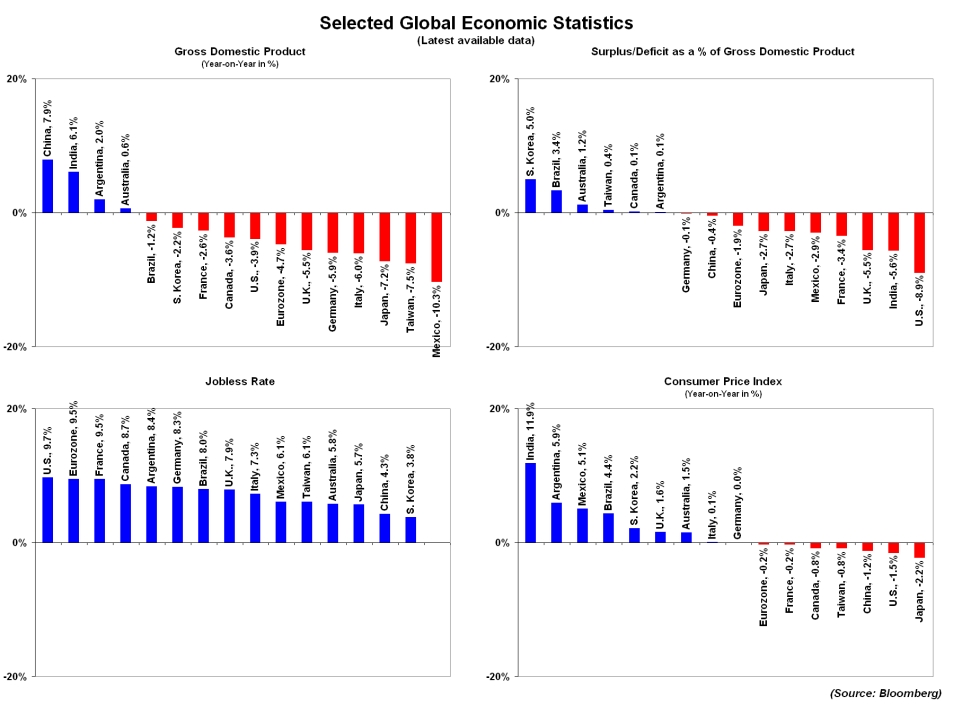

Even though the global economy is experiencing the worst downturn since World War II, that doesn’t mean every country is being equally affected. Leaving aside the (big) question of how reliable official statistics are, it’s clear that there’s something of a divide between the developed and emerging worlds.

For now, at least, the economic up-and-comers are at the top of the list as far as growth and inflation are concerned, though there are some interesting exceptions (e.g., Taiwan).

Not surprisingly, the more mature economies feature prominently among those countries with high rates of unemployment, which likely stems from differences in wage rates and labor market rigidities, among other things.

Otherwise, India is a curious amalgamation: high growth, high inflation, and a budget deficit that is second only to that of the U.S. (note: India’s unemployment data was not available from Bloomberg).

No doubt some will claim that “decoupling” accounts for the divergences, but from what I remember, proponents of the theory had argued before the current crisis began that the emerging world would be relatively unaffected by a slowdown in the U.S. Clearly, that has not been the case.

What's been said:

Discussions found on the web: