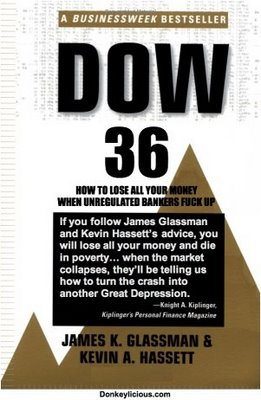

“This book will convince you of the single most important fact about stocks at the dawn of the twenty-first century: They are cheap….If you are worried about missing the market’s big move upward, you will discover that it is not too late. Stocks are now in the midst of a one-time-only rise to much higher ground–to the neighborhood of 36,000 on the Dow Jones industrial average.”

-Glassman and Hassett, introduction, Dow 36,000

>

Call it the audacity of cluelessness: Let us congratulate James K. Glassman and Kevin Hassett, the authors of the incredibly money losing advice in their book Dow 36,000, on their 10 year anniversary. The book forecast that lofty number would be obtained in 3 to 5 years; it was published precisely 10 years ago today.

In the ensuing decade since this book (and I use the term lightly) was published, the Dow is still below where it was 10 years ago, rather than tripling in price. The Nasdaq remains more than 60% below its highs of one decade ago.

I tried to read the book as a history lesson, but it was, to be blunt, unreadable. I got through enough to learn the basic argument they made: Stocks have been undervalued for decades, and over the ensuing years, we should expect a dramatic one-time upward adjustment in stock prices. Why? People were about to figure out what only these two geniuses already knew (hubris anyone?).

I tried to read the book as a history lesson, but it was, to be blunt, unreadable. I got through enough to learn the basic argument they made: Stocks have been undervalued for decades, and over the ensuing years, we should expect a dramatic one-time upward adjustment in stock prices. Why? People were about to figure out what only these two geniuses already knew (hubris anyone?).

The book contain numerous implications that were questionable back then and today, look utterly ridiculous:

• Buy & Hold is the best strategy;

• Value is relative;

• Risk is wildly overstated by naysayers;

• The economic cycle has been defeated!

Perhaps the greatest sin in this foolishness is extrapolation — during the peak boom years, stock prices tripled every 7 years. The forecast of Dow 36,000 simply tacked on another 7 year run at a record breaking pace on top of an 18 year bill market. Smart!

But rather than merely engage in schadenfreude, let’s see what lessons we can learn from their errors. Here is what I can deduce as valuable lessons from the foolishness in their book:

1. Every Bull market is followed by a Bear market.

2. Buy & Hold is fine during a secular bull market; it is ruinous during a secular bear market;

3. Returns are a function of Risk: The greater return you seek, the more risk you must be willing to accept;

4. Valuation matters a great deal;

5. “Risk” as it is defined means that sometimes, you lose. Big.

6. The business cycle still exists, and recessions will occur regularly;

7. Markets are subject to bouts of emotional extremes. They are after all, just crowds of humans, where at times logic does not prevail.

8. Capital preservation is just as important as performance. Returns become irrelevant if during the inevitable downturn you lose all your money.

9. Extrapolating the current trend to infinity (or zero) is foolhardy;

10. Politics and investing make for terrible bedfellows.

There are always lessons to be learned from each turn of the wheel in the market. I find its much less expensive to learn them from other people’s mistakes, rather than my own . . .

>

Related:

Dow 36,000 (excerpt)

by James K. Glassman and Kevin A. Hassett

The Atlantic, September 1999

http://www.theatlantic.com/issues/99sep/9909dow.htm

Waiting for ‘Dow 36,000’

Interview by Carlos Lozada

Washington Post, March 8, 2009; Page B02

http://www.washingtonpost.com/wp-dyn/content/article/2009/03/04/AR2009030403455.html

Dow 36,000: Booknotes Interview

October 3, 1999

http://www.booknotes.org/Transcript/?ProgramID=1535

Kevin Hassett, Bloomberg columns

http://www.bloomberg.com/news/commentary/hassett.html

Kevin Hassett, Wikipedia

http://en.wikipedia.org/wiki/Kevin_Hassett

What's been said:

Discussions found on the web: