If a picture is worth a 1,000 words, well then consider the following 3k wordsworth of info on the current recession (in size order):

>

Comparing Recession Percentage of Job Losses

via Chart of the Day

>

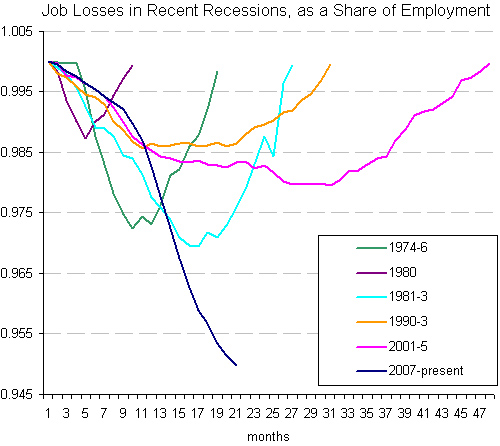

Comparing Recession Job Losses as % of Employment

via Economix

>

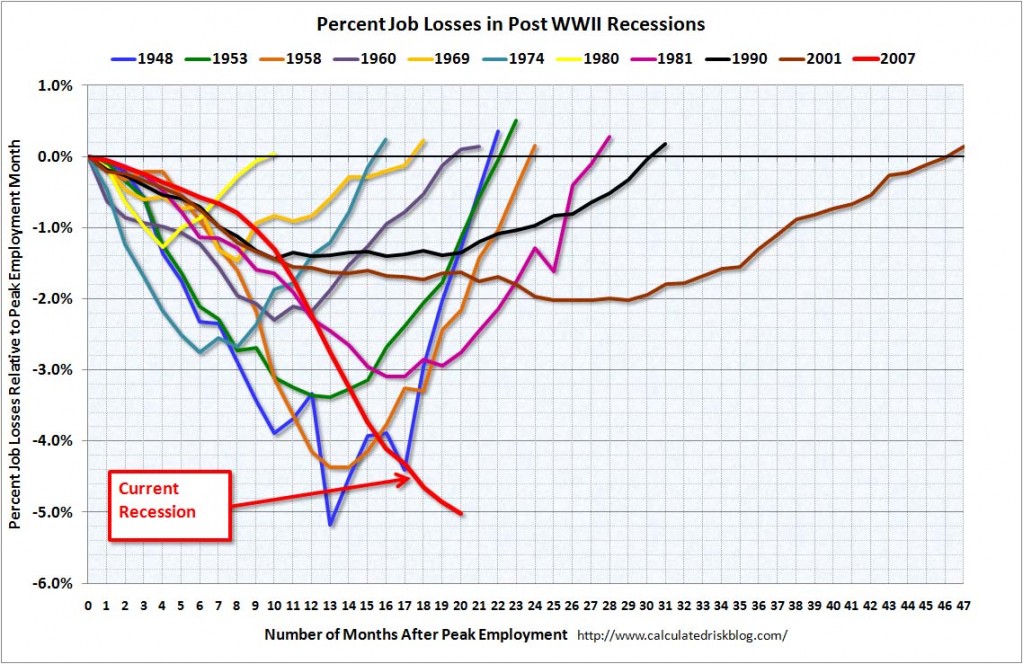

Comparing Percentage Job Losses, post WW2

via Calculated Risk

What's been said:

Discussions found on the web: