Existing Home Sales fell 5.4% last month, despite the nonsense you have read elsewhere.

NAR continues to bullshit America with their garbage data and spin, month after month, with few people calling them on it. Well, I’ve had it up to here with their garbage:.

Big Rebound in Existing-Home Sales Shows First-Time Buyer Momentum

Existing-home sales bounced back strongly in September with first-time buyers driving much of the activity, marking five gains in the past six months, according to the National Association of Realtors

No, home sales did not rebound — that was purely the result of SEASONAL ADJUSTMENTS

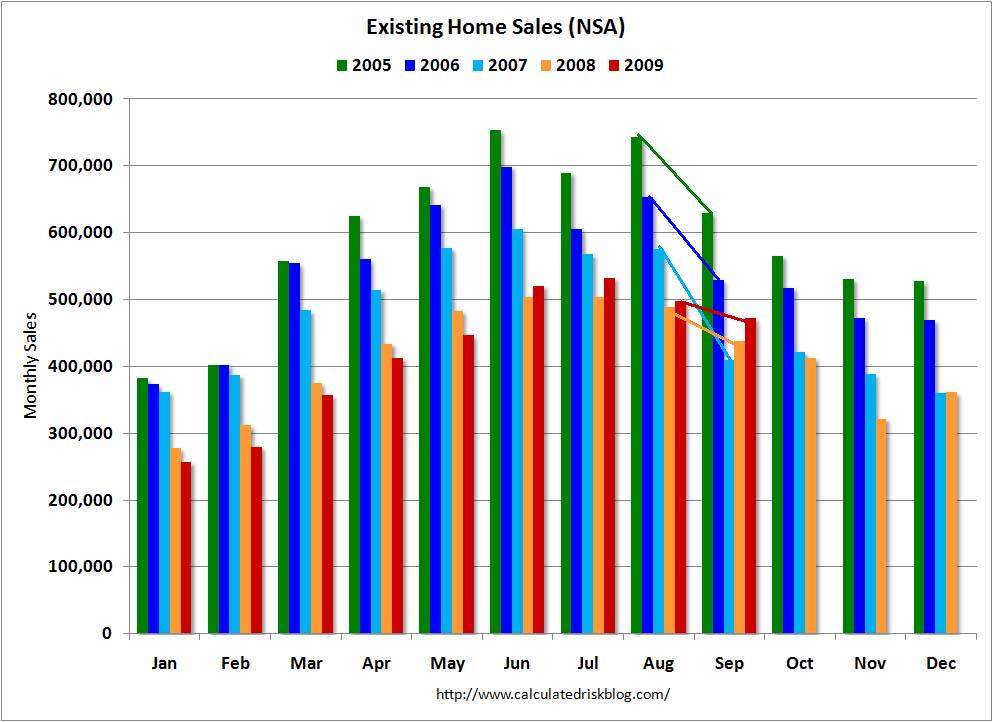

As you can see on the NON SEASONALLY adjusted chart below, from August to September (Red Bar) Sales actually dropped. In prior years — 2005, 2006, 2007, and 2008 — there was always a big fall from August to September.

This year, the fall was more modest.

Why was this year so different? We have ZIRP (which will eventually go up) and a large 1st time buyers tax credit that is scheduled to expire. Hence, the unusual September activity that dos not reflect the traditional drop off.

Mark Hanson notes that on a NSA basis, Existing Home Sales actually dropped 5.2% — this was the second straight monthly drop on an NSA basis.

Mark adds:

The NAR’s attempt to annualize seasonality never before seen has resulted in a headline very far off base . . . The fact is, Sept NSA sales were above last year’s 438k but below last month’s 498k coming in at 472k as shown below. In addition, sales prices fell. This pulled-forward demand sets up the slow season to be one of the slowest on record.

The tax credit effectively extended the purchase season which is why sales were even this strong. But when you consider the hundreds of billions spent to prop up the housing market, which only resulted in 34k additional sales over last September (one of the worst years on record for housing) and fewer sales YoY in CA, sales were really not that great. When organic sales go away suddenly for the season, which will happen in the near-term whether the tax credit is extended or not, it sets sales and prices up for the largest swings lower we have seen since all this began two years ago.

That’s precisely correct — the usual selling season was extended due to the tax credit.

>

click for larger chart

courtesy of calculated risk

>

>

I am honestly unsure of whether the folks at the NAR are dumb as lawn furniture and make these misrepresentations honestly — or whether are just another group of disgusting spin doctors, willfully peddling lies because it helps their own agenda.

Those are pretty much the only options: Idiots or full of shit. (You decide).

>

Source:

Big Rebound in Existing-Home Sales Shows First-Time Buyer Momentum

October 23, 2009

http://www.realtor.org/press_room/news_releases/2009/10/rebound_shows

What's been said:

Discussions found on the web: