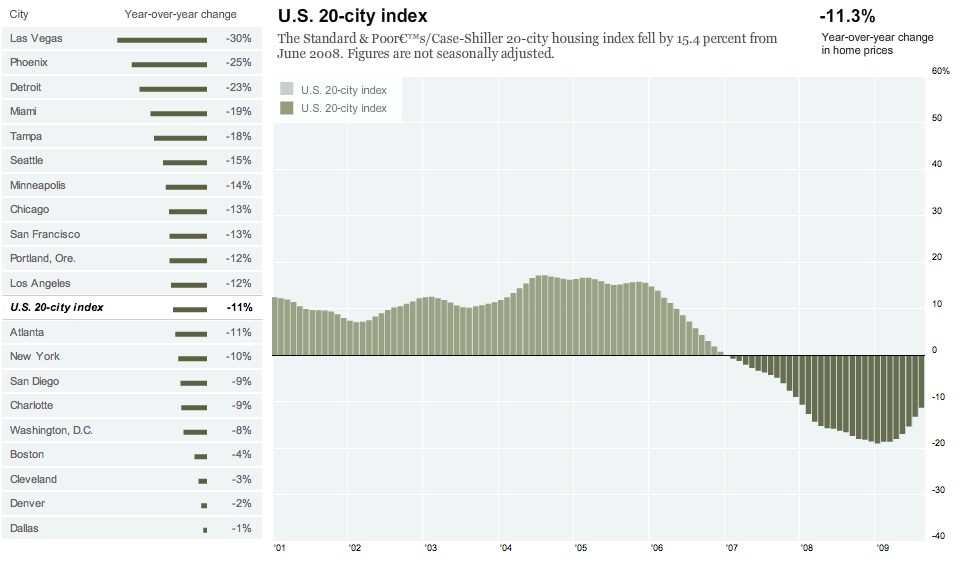

Nice interactive chart in the NYT, in an article that is surprisingly realistic:

“Even as new figures show house prices have risen for three consecutive months, concerns are growing that the real estate market will be severely tested this winter.

Artificially low interest rates and a government tax credit are luring buyers, but both those inducements are scheduled to end. Defaults and distress sales are rising in the middle and upper price ranges. And millions of people have lost so much equity that they are locked into their homes for years, a modern variation of the Victorian debtor’s prison that is freezing a large swath of the market.”

>

Home Prices in Selected Cities, Through August 2009

click for graphic

via NYT

>

Source

Fears of a New Chill in Home Sales

DAVID STREITFELD

NYT, October 27, 2009

http://www.nytimes.com/2009/10/28/business/economy/28home.html

What's been said:

Discussions found on the web: