With September NFP due to come out tomorrow, it might behoove us to look beyond the month to month data to the longer term.

To do so, I direct your attention to at a recent report, America’s New Post-Recession Employment Arithmetic. It is an interesting, though somewhat dispiriting, review on the Employment situation, past present and future. The report comes from Advance Realty and Rutgers, and it reviews the past few decades employment data to discern what long term implications might be for employment in any economic recovery.

The key data points are:

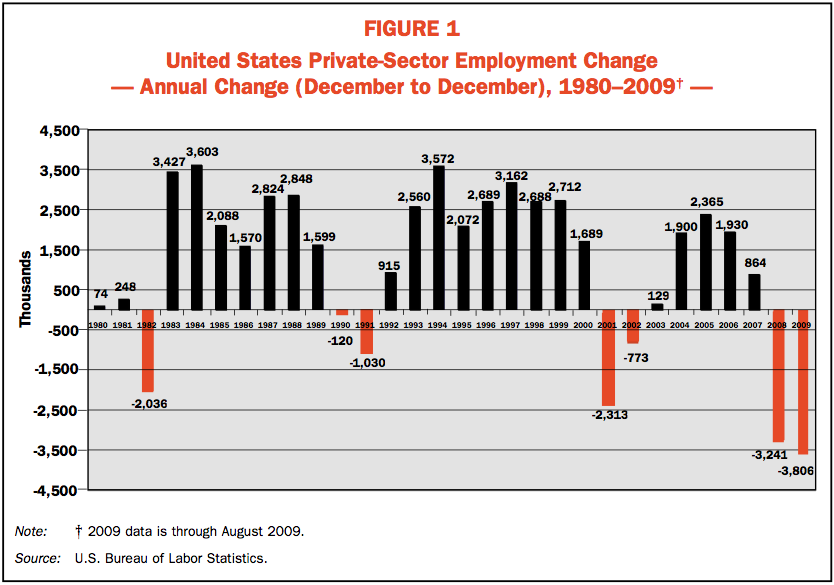

• The Great 2007–2009 recession is the worst employment setback in the United States since the Great Depression.

• In the twenty months from December 2007 (the start of the recession) to August 2009 (the last month of available data as of this analysis), the nation lost more than 7.0 million private-sector jobs.

• The recession followed a very much-below-normal economic expansion (November 2001–December 2007) that was characterized by relatively weak private-sector employment growth of approximately 1 million jobs per year.

• This was less than one-half of the job-growth gains of the two preceding expansions (1982–1990 and 1991–2001), when average annual private-sector employment grew by 2.4 million jobs per year and 2.2 million jobs per year, respectively.

• In the preceding two expansions combined, private-sector employment growth per year was approximately 435,000 jobs higher than the annual growth in the number

of people in the labor force.employment deficit.• The weak economic expansion sandwiched between two recessions (2001, and 2007–2009) produced a lost employment decade.

• As of August 2009, the nation had 1.3 million (1,256,000) fewer private- sector jobs than in December 1999. This is the first time since the Great Depression of the 1930s that America will have an absolute loss of jobs over the course of a decade.

• From 1980-2000, the US gained a 35.5 million private-sector jobs. During the current decade, America has lost more than 1.7 million private-sector jobs.

• Total “employment deficit” could approach 9.4 million private-sector jobs by December 2009.

The “Harsh Arithmetic of the Employment Deficit” means that we will not likely return to 2007 employment levels until (ugh) 2017.

The entire report is very readable, and chock full of charts and tables.

>

>

Hat tip Economix

>

Source:

America’s New Post-Recession Employment Arithmetic

James W. Hughes and Joseph J. Seneca

Rutgers University, September 2009

http://www.policy.rutgers.edu/News/A&RR-FINAL_9.30.pdf

What's been said:

Discussions found on the web: