A new research report out of University of North Carolina at Chapel Hill looks at the impact of federal preemption of state Anti-Predatory Lending laws. The key factor was the decision by the Bush White House in 2004 to preempt state lending standards.

You will be not be surprised at the net results.

States that have Anti-Predatory Lending (APL) laws are associated with a lower rate of mortgage defaults than non-APL states. Typically, Anti-Predatory Lending laws require verification of borrowers’ repayment ability, as well as include limits on fees, rates and prepayment penalties. States without these restrictions and verification requirements have higher default rates.

The report concluded that in States where the APLs “require a lender to consider a borrower’s ability to pay and ban prepayment penalties” there are “significantly lower default rates.”

Why did the US preempt state APL laws? There was the ideological belief that states were interfering with profits and “financial innovation:” In February 2004, the Bush White House, working through the Office of the Comptroller of the Currency (OCC) officially preempted national banks from state laws regulating mortgage credit, including state anti-predatory lending laws. (This was far broader than the 1996 regulatory preemption by the Office of Thrift Supervision (OTS) applied to federally chartered S&Ls).

The Bush White House claimed that banks should “only be subject to federal laws regulating mortgage credit.”

Recall that when out of power, Federalists and Conservatives strongly argued that state rights must be respected and that smaller federal government intervention was the intent of the country’s founders. (Funny how those arguments faded once they obtained power).

What happened once the preemption took effect? The results were predictable: The share of high-cost loans that were preempted in APL states increased from 16 percent in 2004 to 46 percent in 2007. These high cost/sub-prime loans defaulted in unusually higher numbers. Hence, suggests the study, such preemption is to blame, at least in part, for the current foreclosure crisis.

Here’s an excerpt from the study:

“This study looks at the link between state laws and mortgage default rates, specifically whether APLs are associated with lower rates of residential mortgage default. Overall, we observe a lower default rate for neighborhoods in APL states, in states requiring verification of borrowers’ repayment ability, in states with broader coverage of subprime loans with high points and fees, and in states with more restrictive regulation on prepayment penalties.

We believe that these findings are remarkable, since they suggest an important and yet unexplored link between APLs and foreclosures.

Moreover, given the wide range of factors influencing foreclosures, including house price declines, rising unemployment, and differences in state foreclosure processes, these descriptive statistics are likely to result in an underestimation of the positive impacts of APLs. These findings also point to the need to understand how federal preemption affected the effectiveness of state APLs.”

Ironically, former NYS attorney general and governor Eliot Spitzer called attention to this in early 2008: Spitzer wrote that the 2004 decision to preempt states made the White House the Predatory Lenders’ Partner in Crime:

“Several years ago, state attorneys general and others involved in consumer protection began to notice a marked increase in a range of predatory lending practices by mortgage lenders. Some were misrepresenting the terms of loans, making loans without regard to consumers’ ability to repay, making loans with deceptive “teaser” rates that later ballooned astronomically, packing loans with undisclosed charges and fees, or even paying illegal kickbacks. These and other practices, we noticed, were having a devastating effect on home buyers. In addition, the widespread nature of these practices, if left unchecked, threatened our financial markets.

Even though predatory lending was becoming a national problem, the Bush administration looked the other way and did nothing to protect American homeowners. In fact, the government chose instead to align itself with the banks that were victimizing consumers.”

Of the many foibles, errors of judgment, and otherwise questionable ideological decisions of the Bush administration, this probably has the most significant and damaging effects, at least as it relates to the current credit crisis.

>

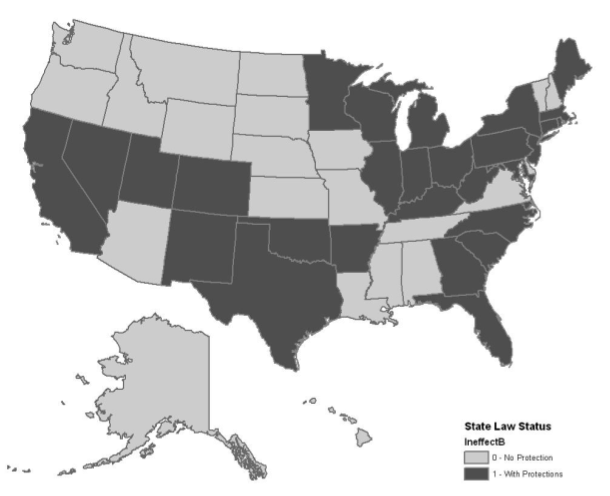

States with Anti-predatory Lending Laws (Pre-2008)

>

Sources:

STATE ANTI-PREDATORY LENDING LAWS: Impact and Federal Preemption Phase I Descriptive Analysis

DRAFT: Federal preemption of state anti-predatory lending laws

Lei Ding, Wayne State University

Roberto G. Quercia, University of North Carolina at Chapel Hill

Alan M. White, Valparaiso University

University of North Carolina at Chapel Hill, October 2009

http://www.ccc.unc.edu/documents/Phase_I_report_Final_Oct5,2009_Clean.pdf

Center for Community Capital

College of Arts and Sciences

The University of North Carolina at Chapel Hill

http://www.ccc.unc.edu/

The UNC paper was funded by a grant from The National State Attorneys General Program at Columbia Law School, which received funding from the Consumer Protection Fund of the North Carolina Department of Justice.

See also:

Predatory Lenders’ Partner in Crime

How the Bush Administration Stopped the States From Stepping In to Help Consumers

Eliot Spitzer

Washington Post, February 14, 2008

http://www.washingtonpost.com/wp-dyn/content/article/2008/02/13/AR2008021302783.html

What's been said:

Discussions found on the web: