No surprise here: The Federal Reserve Bank of New York, in a desperate headlong rush to rescue American International Group, screwed the pooch. Despite holding all of the cards, cash and power, they still managed to manuver themselves into a corner with “little negotiating room.”

So says the most recent audit from the Office of the Special Inspector General (SIG) for the TARP program (full embed here) :

“SIGTARP concludes that: (1) the original terms of federal assistance to AIG, including the high interest rate it adopted from the private bank’s initial term sheet, inadequately addressed AIG’s long term liquidity concerns, thus requiring further Government support; (2) FRBNY’s negotiating strategy to pursue concessions from counterparties offered little opportunity for success, even in light of the willingness of one counterparty to agree to concessions; (3) the structure and effect of FRBNY’s assistance to AIG, both initially through loans to AIG, and through asset purchases in connection with Maiden Lane III effectively transferred tens of billions of dollars of cash from the Government to AIG’s counterparties, even though senior policy makers contend that assistance to AIG’s counterparties was not a relevant consideration in fashioning the assistance to AIG; and (4) while FRBNY may eventually be made whole on its loan to Maiden Lane III, it is difficult to assess the true costs of the Federal

Reserve’s actions until there is more clarity as to AIG’s ability to repay all of its assistance from the Government. SIGTARP also draws lessons that should be learned regarding the importance of transparency andratings agencies had on the AIG bailout.”

In other words, the deal that was cut in November 2008 with AIGs counter-party banks resulted in those banks being paid off in full for high risk credit-market bets.

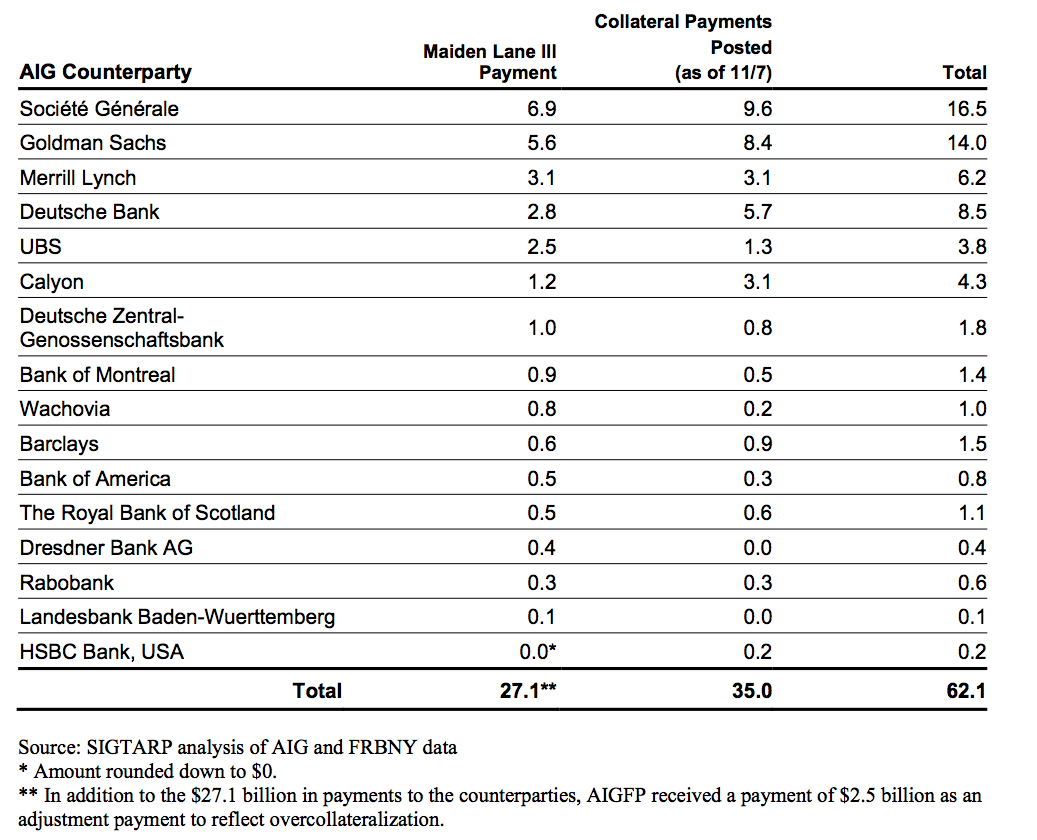

Had AIG gone bankrupt, these firms would have recieved pennies on the dollar. The banks that benefited the most included Goldman Sachs Group Inc., Merrill Lynch and large French banks Société Générale and Calyon. (See table below)

The New York Fed said its goal was to “prevent a system-wide collapse” and not obtain the best deal possible. So they got played for patsies.

Here’s the WSJ:

The “SIGTARP” audit provides a window into a bailout effort that has been shrouded by a lack of disclosure — acknowledged in the report — and questions over why the U.S. government in effect funneled tens of billions of dollars to U.S. and European banks that were AIG’s trading partners.

In November 2008, less than two months after the New York Fed first bailed out AIG with an $85 billion credit line, the government restructured its aid to AIG as the insurer’s cash needs mounted amid the market downturn. The revamped package included a company called Maiden Lane III buying complex mortgage-linked securities from U.S. and European banks to cancel insurance contracts that AIG’s financial–products division had written on the securities. The banks were effectively paid par, or 100 cents on the dollar, for those securities, which had declined significantly in value due to rising home-loan defaults.

The report acknowledged challenges the regulators faced, including insistence by most of the banks and a French bank regulator that they be paid in full. But the report said the “refusal” of the Federal Reserve and New York Fed “to use their considerable leverage,” in negotiations with the trading partners “made the possibility of obtaining concessions from those counterparties extremely remote.”

Its simply embarrassing and pathetic . . .

>

Sources:

FACTORS AFFECTING EFFORTS TO LIMIT PAYMENTS TO AIG COUNTERPARTIES

SIGTARP-10-003

NOVEMBER 17, 200

http://bit.ly/49y3iI

SIGTARP Audit

http://www.sigtarp.gov/audits.shtml

Audit Is Critical of N.Y. Fed in AIG Bailout

SERENA NG and CARRICK MOLLENKAM

WSJ, NOVEMBER 16, 2009

http://online.wsj.com/article/SB10001424052748704431804574540290325376348.html

What's been said:

Discussions found on the web: