Everyone knows that senior execs at Bear Stearns and Lehman Brothers were paid largely in stock, and that they lost most of their wealth when the companies collapsed, right?

Turns out, not so much:

“Three professors at Harvard are disputing that logic in a new study, saying it is an urban myth that executives at Bear and Lehman were wiped out along with their companies.

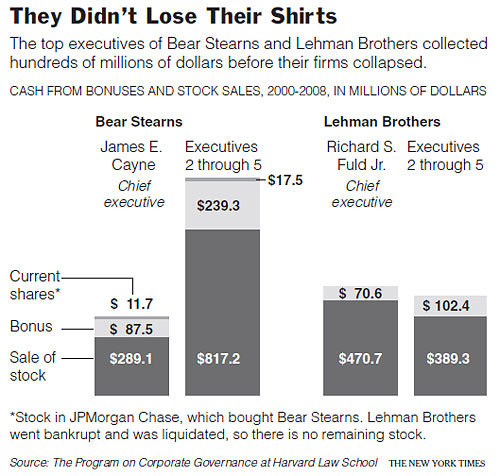

Though the chiefs at both investment banks lost more than $900 million in their stock holdings, the professors argue that it is important to also consider all the riches the bankers took off the table in the years preceding the crisis.

At Lehman, the top five executives received cash bonuses and proceeds from stock sales totaling $1 billion between 2000 and 2008, and at Bear, the top five received more than $1.4 billion, according to the study, which was released on Sunday night on the Web site of the Program on Corporate Governance at Harvard Law School.

The payouts came in the form of cash bonuses as well as thousands of shares of stock that the executives sold as the share prices of their companies soared. Most of the executives sold far more shares during that period than the number they held when their companies hit bottom.”

Another myth of the Bailout era dies . . .

>

>

Source:

Executives Kept Wealth as Firms Failed, Study Says

LOUISE STORY

NYT, November 22, 2009

http://www.nytimes.com/2009/11/23/business/23pay.html

What's been said:

Discussions found on the web: