I had lunch last week with Rolfe Winkler, who is an up and comer in the blog world, a thinking man’s Felix Salmon.

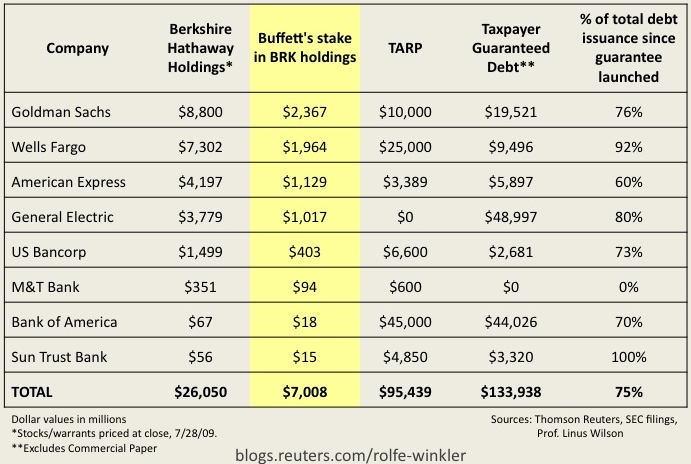

He is similarly annoyed with St. Warren — but rather than engage in my sophmoric venom spew, he went to the spreadsheet to discover that Buffet owns major stakes in 8 companies that have received more than $100 billion in government bailouts.

Capitalist? Hardly. Sounds more like just another crony to me.

Rolfe also posts this fabulous chart:

Buffett’s Bailouts

via Reuters

What's been said:

Discussions found on the web: